MRM EXCLUSIVE: Consumer Data Analytics Reveal Dining Patterns to Attract Customers

Modern Restaurant Management

OCTOBER 16, 2023

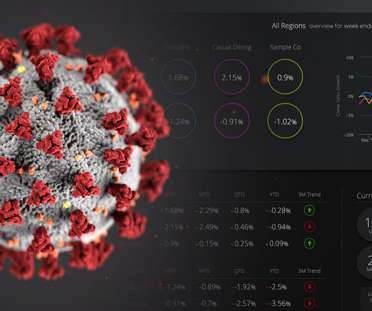

restaurants today than in 2019 and it is not clear when —if ever — they’re coming back. That’s roughly 72,000 fewer than in 2019. With those stats in mind, Causeway Solutions conducted consumer research* on today’s dining trends compared to our research over the past few years. Remember 2020?

Let's personalize your content