The Ultimate Guide to Getting a Restaurant Business Loan

7 Shifts

NOVEMBER 22, 2021

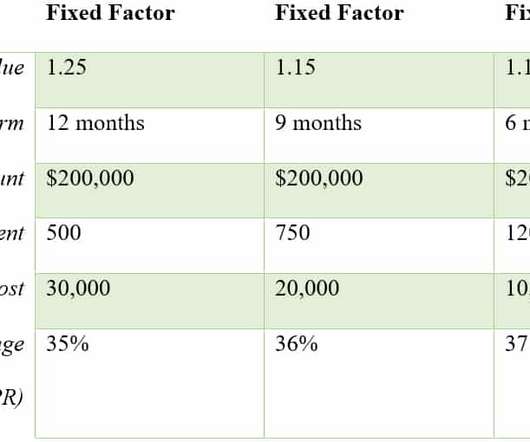

It also requires money to open a restaurant and build it out, buy equipment and finance the operation until it reaches break-even. In this article, you'll learn how to get a business loan for your restaurant so you can make your dream of starting or growing your restaurant a reality. Create a Restaurant Business Plan.

Let's personalize your content