Restaurant Sales Remain Strong With Last Two Months Posting Highest Growth Since March

Black Box Intelligence

NOVEMBER 17, 2022

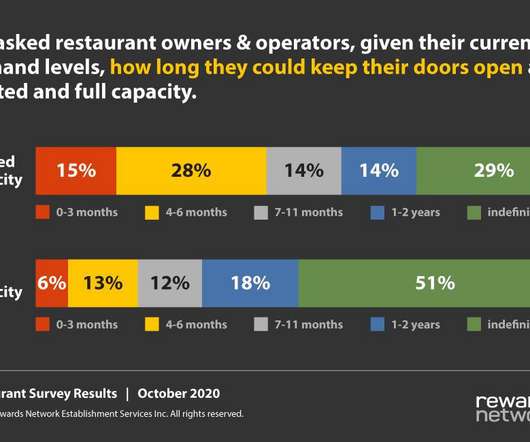

On the guest count front, there continues to be good and bad news. Leading the industry in average check growth during October were casual dining and quick service, while the segments with the smallest increase in check were fine dining and upscale casual. In fact, October’s same-store sales growth of +5.2%

Let's personalize your content