Make High-Traffic Times More Profitable with These Payment Optimization Tips

Modern Restaurant Management

JANUARY 15, 2025

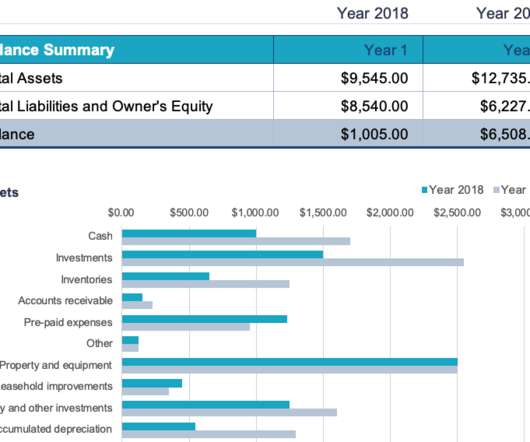

The restaurant industry continued to grow in 2024 with sales forecasted to top $1 trillion for the first time in history, according to the National Restaurant Association’s 2024 State of the Restaurant Industry report. Auditing monthly merchant statements can take weeks or even months to complete.

Let's personalize your content