The Advantages of Connecting Your Restaurant Group’s Payroll and Accounting Systems

Restaurant365

DECEMBER 10, 2021

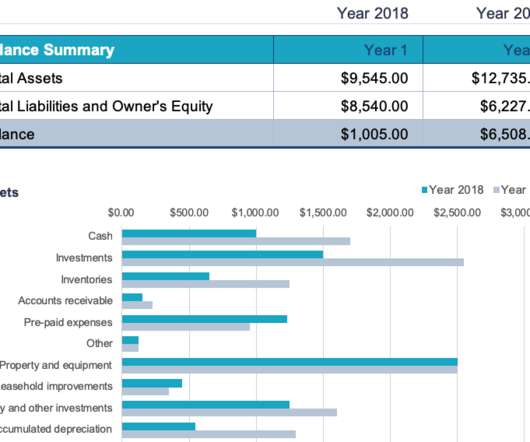

A period with seven weekend days, as opposed to one with nine, will likely generate much different sales and expense levels. For instance, if you run payroll weekly or bi-weekly, a four-week accounting period allows you to align labor costs with sales, informing accurate, useful labor cost calculations.

Let's personalize your content