[Guide] How to Implement Digital Tip Payouts at your Restaurant

7 Shifts

AUGUST 2, 2023

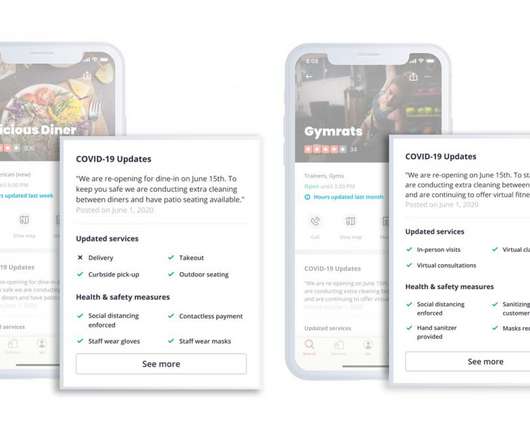

Reporting and tracking: These capabilities allow managers to analyze tip distributions, identify trends, and generate comprehensive reports for internal auditing and tax purposes—all without having to make their own spreadsheets. Example: Regular monitoring and auditing of the digital tip payouts will be conducted.

Let's personalize your content