How to Manage Cash Flow During Restaurant Restrictions

Restaurant365

APRIL 1, 2020

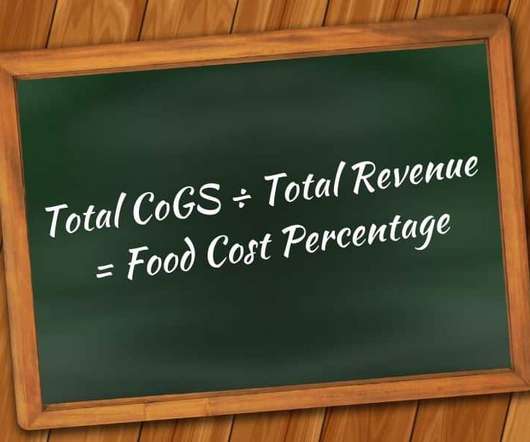

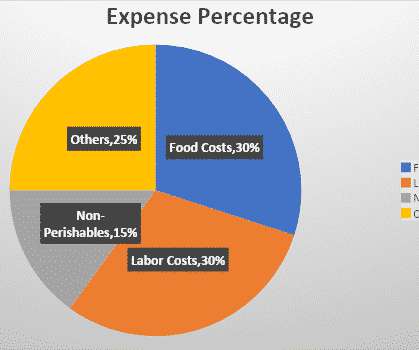

Tracking and understanding your restaurant’s cash flow is essential, whether business is booming, or times are tough. A healthy, positive cash flow is necessary to pay your bills and grow sales. Monitoring your cash flow is more important than ever during the COVID-19 outbreak. How to calculate restaurant cash flow.

Let's personalize your content