MRM Research Roundup: End-of-April 2020-COVID-19 Effects Edition

Modern Restaurant Management

MAY 1, 2020

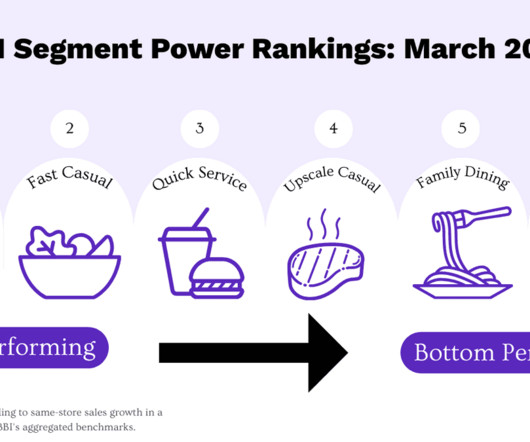

Other businesses have seen a surge of consumer interest, including chicken-wing joints (+84 percent), pizzerias (+71 percent) and fast-food restaurants (+55 percent). dine out more often to fulfill basic needs and gravitate toward drive-thru and take-away options associated with QSR and fast casual. In the U.K. In the U.K.,

Let's personalize your content