Successful Restaurant Accounting for Non-Accountants

Restaurant365

SEPTEMBER 23, 2021

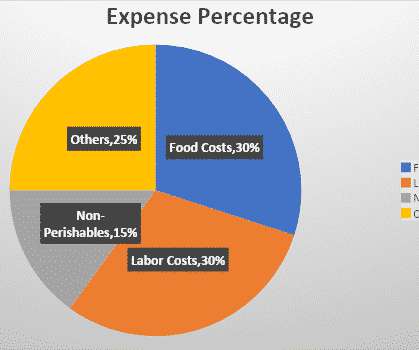

Whether you’re a bookkeeper, accountant, restaurant owner, or store-level manager, understanding the basics of accounting can pay dividends for your business. Healthy accounting procedures for restaurants can help you manage food and labor costs, understand your profits and losses, and make strategic decisions about expenses and investments.

Let's personalize your content