Navigating Colorado's Tip Laws: A Guide for Employers

7 Shifts

DECEMBER 6, 2023

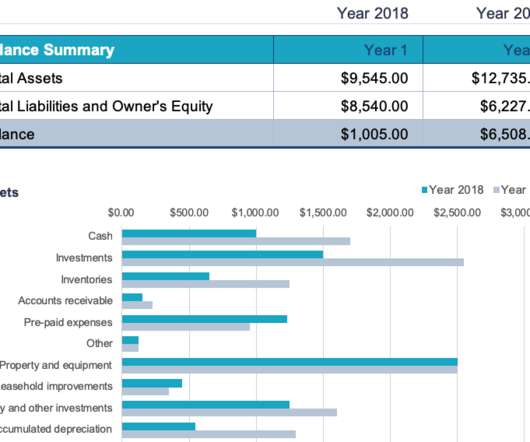

Tip laws differ from national standards in some areas, and staying on top of potential changes as bills make their way through the legislative process takes time and energy. The tipped minimum wage in Colorado is $10.63 So employers can claim a tip credit of $3.02 Who is considered a tipped worker? What counts as a tip?

Let's personalize your content