Restaurant Bookkeeping: Comprehensive Guide to Master Bookkeeping

7 Shifts

MAY 1, 2024

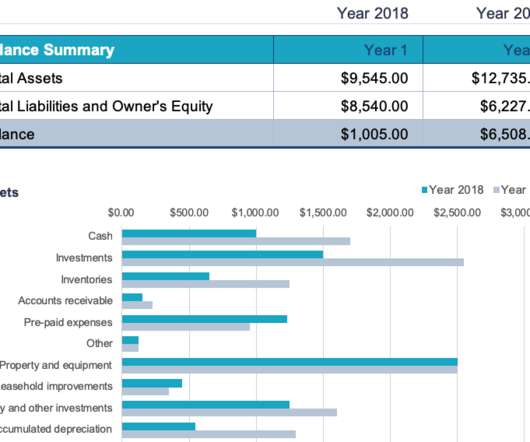

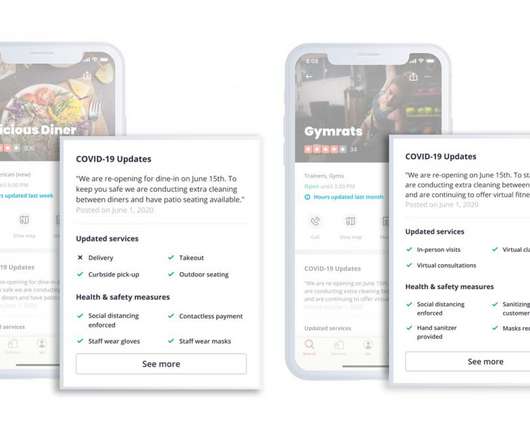

Table of Contents 5 easy steps to simplify bookkeeping in the restaurant industry Essential accounting and bookkeeping reports for restaurant owners and managers Identifying and reducing controllable costs in the restaurant business Should I outsource restaurant bookkeeping or do it myself? Even those new to bookkeeping can use it!

Let's personalize your content