Leveraging POS Systems to Future-Proof Your Restaurant and Maximize Profits

Modern Restaurant Management

APRIL 13, 2022

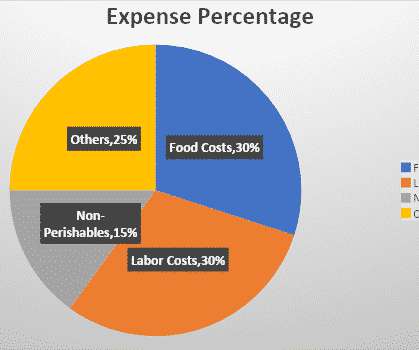

A fragmented supply chain is also increasing ingredient costs, leading restaurants to balance staff churn with a changing menu to keep revenue consistent. Monitoring Supply Can Curb Waste and Loss. Additionally, many restaurants are expanding to include traditional benefits such as health insurance and retirement savings plans.

Let's personalize your content