How To Start A Small Restaurant In The Spring

MBB Hospitality

APRIL 14, 2023

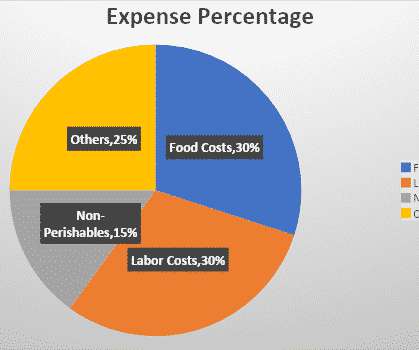

Your budget should cover the costs tied to research, inventory supplies, licensing fees, staff wages, and the usual overhead costs. This includes your day-to- day operations, setting policies for customer service, ordering procedures for food and beverages, and staff requirements needed for various shifts.

Let's personalize your content