Restaurant Budgeting: How to Create A Restaurant Budget

7 Shifts

MAY 23, 2024

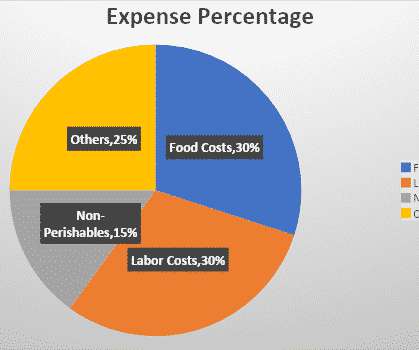

Managing a restaurant is not for the faint-hearted. This includes: Net Sales: The total revenue derived from your sale of food and beverages. However, as a rule, the primary costs you can expect in running your restaurant are usually related to food, labor, and rent. What are the top 3 expenses of restaurants?

Let's personalize your content