How to Organize and Optimize Your Restaurant Chart of Accounts

Justin GuinnAuthor

Any business owner or operator should be familiar with a chart of accounts. It’s a fundamental accounting tool that keeps track of money flowing in and out of your operation.

The general details tracked by a restaurant chart of accounts can be particularly important because of the slim margins across the industry.

However, there are more efficient tools you can use to gain sales and costing insights without putting undue stress on your chart of accounts.

Read on to learn how to organize and optimize your restaurant chart of accounts. Understand your general ledger chart of accounts relationship. And see what restaurant management tools you can use to take control of real-time restaurant costs.

Restaurant Cost Control Guide

Use this guide to learn more about your restaurant costs, how to track them, and steps you can take to help maximize your profitability.

Why is your restaurant chart of accounts important?

Your chart of accounts (CoA) is the foundation for all financial record keeping at your restaurant. It’s a complete, coded list of all of the liabilities, assets, expenses, and income that go in and out of your business.

Simpler CoAs provide a system for documenting all credits and debits.

More detailed CoAs can help restaurants monitor their operation through data, stay audit-ready, and easily uncover inefficiencies that are costing the business money.

Read this next

How to Save Time and Unlock Costing Insights with Restaurant Invoice Processing Automation

Learn how invoice processing automation is a foundational tool for restaurant operators with invaluable benefits.

What does a common chart of accounts look like?

Most businesses list five primary categories for their chart of accounts. These categories can remain the same for your restaurant operation. They include:

Expenses - This is all of your restaurant costs and money you spend to generate and fulfill sales, including your prime costs (COGS + labor cost), utilities and rent, marketing activities, and more.

Revenue - This is the money your restaurant operation earns, including in-house food and beverage sales, takeout and delivery, catering and pop-up events, merchandise, and any other sales channels.

Liabilities - This is any money your restaurant operation owes, including debts, taxes, and more.

Assets - This is any on-hand cash or valuable item that you can convert into cash, such as food and bev inventories, equipment, and front-of-house furniture.

Equity - This details the ownership interest in your business, such as any stock in your operation that you’ve issued to investors.

This is an example of a simpler chart of accounts. It should be compatible with any accounting system and very easy to manage. The trade-off with it being easier to manage is that you lose out on critical details. The simpler and more general your chart of accounts, the less actionable any data will be from reports tied to it.

Read this next

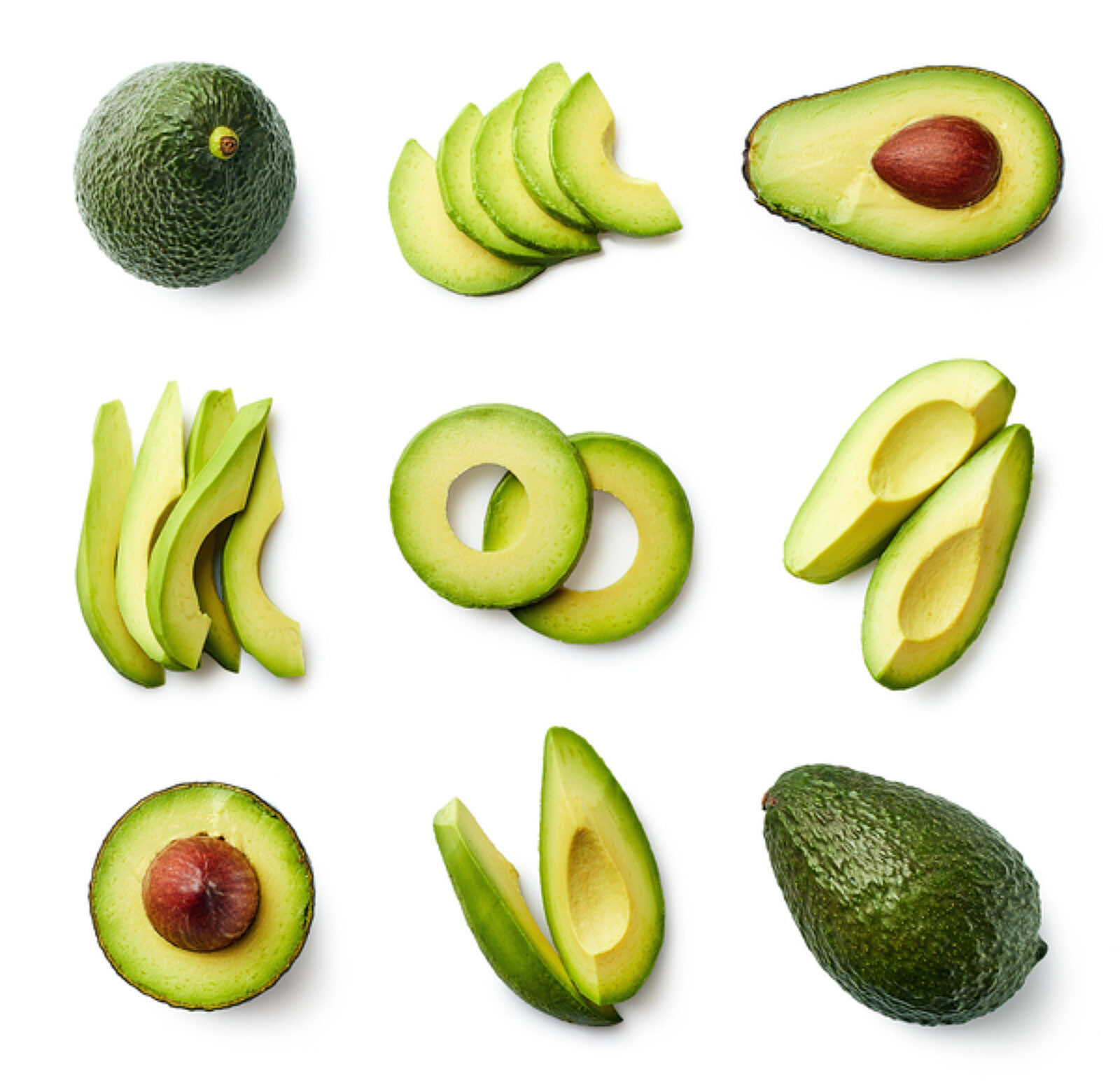

State of Avocado Prices: Wholesale Restaurant Food Cost Trends

See trends and fluctuations for wholesale restaurant avocado prices based on proprietary Toast data.

How can you customize a restaurant chart of accounts?

Restaurant operators are often better served by an industry-specific chart of accounts, such as listing breaking down Cost of Goods Sold through food and non-alcoholic beverage and into food-meat, food-dry goods, etc.

This detail certainly requires more work on the front-end with capturing and appropriately coding invoice and sales data — which is why invoice processing automation is now a must-have tool for restaurant accounting.

Here’s a quick synopsis of what a restaurant specific chart of accounts looks like:

Current assets

Fixed assets

Other assets

Current liabilities

Long-term liabilities

Equity

Sales

Prime costs

Operating expenses

Non-controllable expenses

Corporate overhead & other

Income tax

You can get even more granular on your restaurant-focus within each of the above parent accounts.

For example, here’s what your accounts could look like just within your prime cost parent account:

Beer cost

Cost of goods sold (COGS)

Employee benefits

Employee benefits - insurance & retirement

Employee benefits - other

Employee benefits - payroll taxes

Diary cost, such as egg prices

Labor cost

Liquor cost

Management salaries and wages

Meat cost, such as chicken wing prices

Staff salaries and wages - admin

Staff salaries and wages - back of house (BOH)

Staff salaries and wages - front of house (FOH)

Restaurant chart of accounts vs general ledger

Your chart of accounts and your general ledger are intricately tied together.

Your chart of accounts is the list of accounts that contribute to all money flows in and out of your restaurant. Your general ledger houses all these accounts as well as the money flowing in and out of them.

General ledger codes (or GL codes) is the application of a numerical code to your chart of accounts. This standardizes your accounting practices, making for more programmatic and automated reporting and attribution.

Put another way, your GL codes provide another layer of detail to how you can monitor and categorize your expenses.

What restaurant reports and insights does your CoA provide?

The primary motivation behind standardizing your chart of accounts is to unlock valuable insights that can help you improve your operation. It also serves to track your taxes and general business accountability in case of any audits from the government or investors.

The more detailed and restaurant-specific your chart of accounts, the more actionable insights your reporting can provide on restaurant-specific key performance indicators (KPIs).

These reports are most often created with a combination of accounting systems, point of sale (POS) systems, such as Toast, and specialized restaurant costing software, such as xtraCHEF by Toast.

Here are a few restaurant reports that Toast and xtraCHEF provide for you to glean insights and make more informed decisions for your operation:

|

|

Where do you go from here?

You could decide to be intricately involved in defining your restaurant chart of accounts structure and building GL codes. Or you may want nothing to do with it and outsource everything to a CPA or restaurant bookkeeping service.

Either option is fine as long as your data is consistently and accurately updated — which is where Toast can help.

The all-in-one Toast platform is designed to be your single-source of truth for your restaurant’s performance. You can keep your chart of accounts and general ledger clean and simple by relying on Toast for your operational and financial insights.

Menu Engineering Course

Take this course to make the most of your menu. Learn about menu psychology and design, managing your menu online, and adapting your menu to increase sales.

Is this article helpful?

DISCLAIMER: This information is provided for general informational purposes only, and publication does not constitute an endorsement. Toast does not warrant the accuracy or completeness of any information, text, graphics, links, or other items contained within this content. Toast does not guarantee you will achieve any specific results if you follow any advice herein. It may be advisable for you to consult with a professional such as a lawyer, accountant, or business advisor for advice specific to your situation.