*Originally Published in the Aaron Allen & Associates Newsletter on 04/08/2024

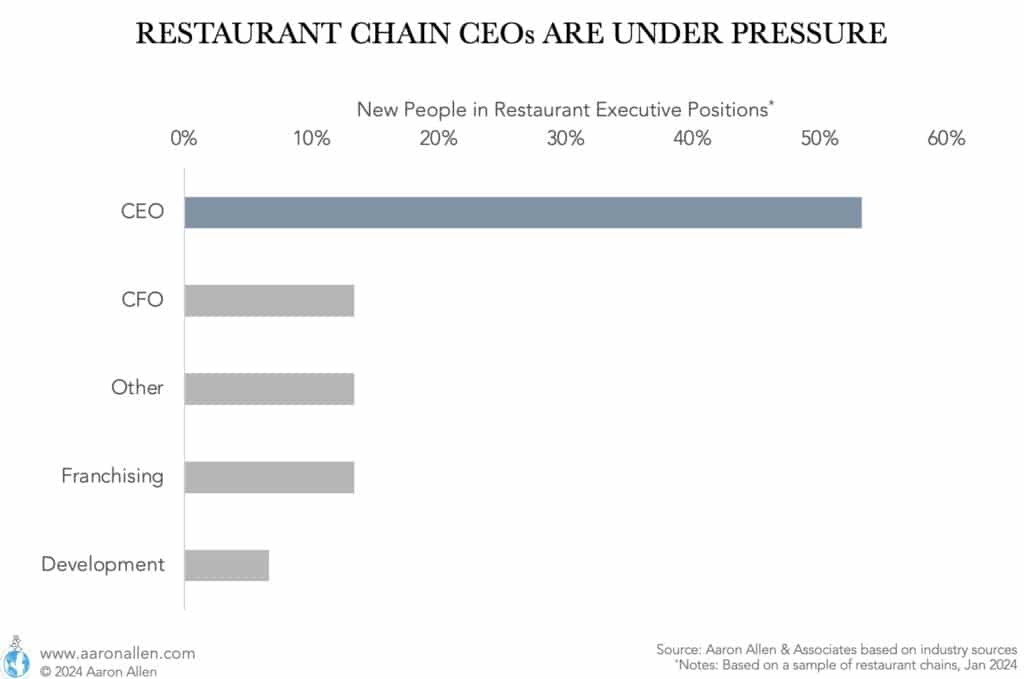

It’s been making the news lately that many C-suite positions in leading restaurant chains are changing hands. We took a look at a sample of companies with new members in their leadership teams, and found that more than half of the replacements were for the CEO.

The changing foodservice landscape puts CEOs under enormous pressure. Being on top and building something remarkable has never been easy. Those doing the homework and putting in the hard work, surrounding themselves with brilliant people, and asking the tough questions of themselves, their teams, and their advisors, have the best shot.

Asking for help is not a sign of weakness, but rather a strategic move towards strength and resilience.

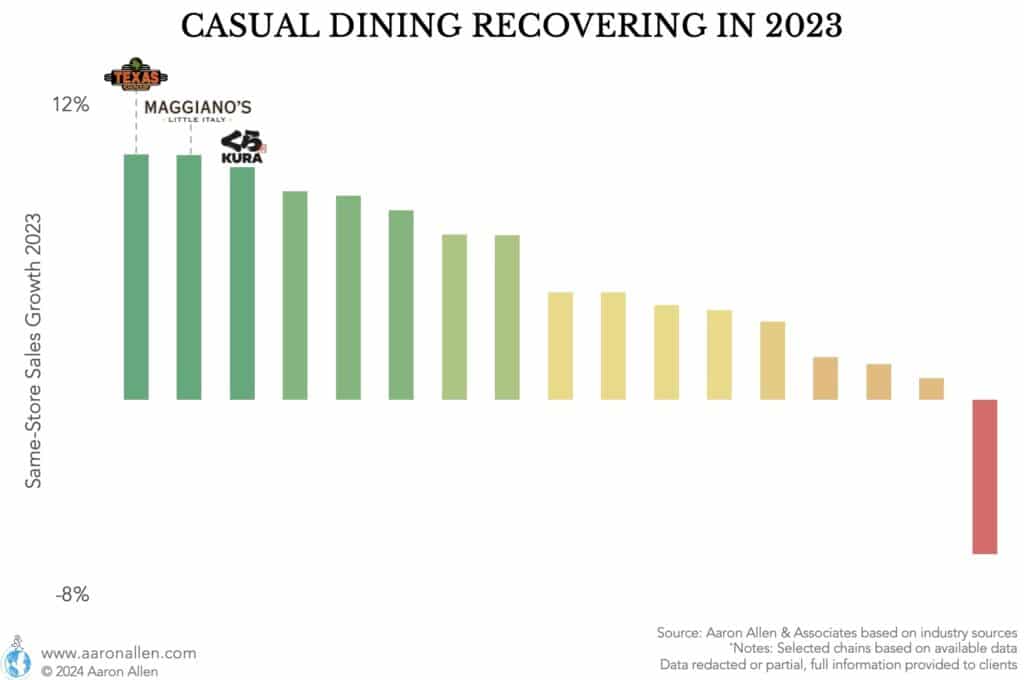

… BUT SOME CASUAL DINING RESTAURANT CEOs ARE USING THE RIGHT STRATEGIES TO BOOST SALES…

The casual dining sector recovered in 2023, and many chains recorded healthy same-store sales growth (leading the pack were Texas Roadhouse, Maggiano’s, and Kura Sushi USA).

How are they doing it? There are a range of strategies to boost same-store sales in a way that is sustainable in the long-term (this article we wrote seven years ago already depicts the problems in the category and the components for the solution). Some are playing to the strength of the “full service” business model (with training and new SOPs) and innovating with technology in the right places. In all cases, it’s worth re-examining the DNA of the brand to set them apart and draw guests in.

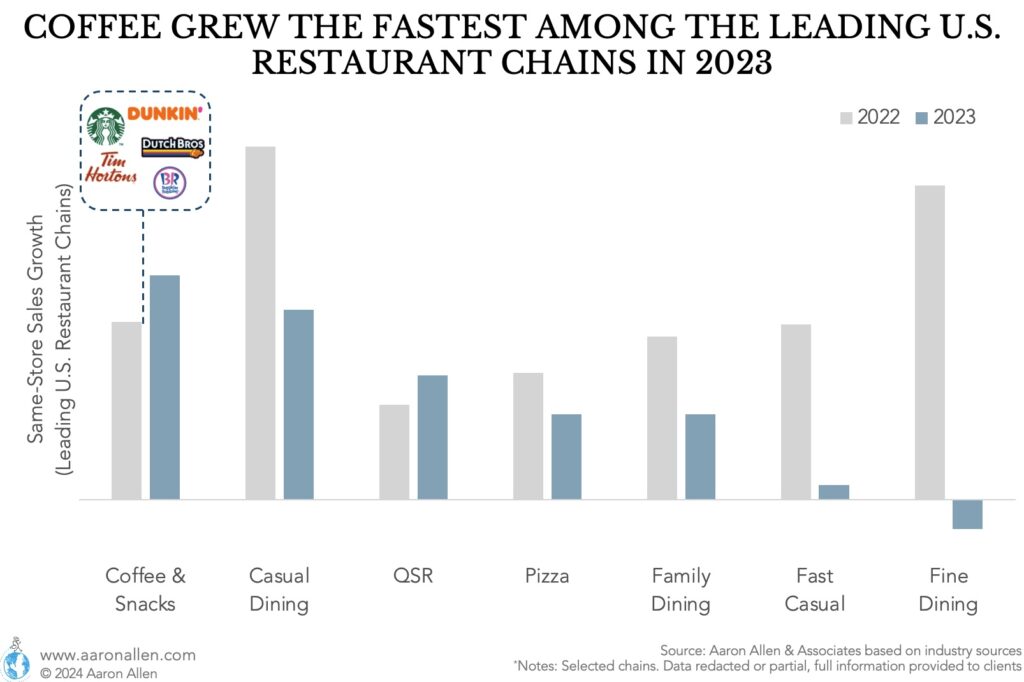

…AND SOME MID-SIZE COFFEE CHAINS ARE GAINING A COMPETITIVE EDGE

Coffee had the greatest same-store sales growth of all restaurant categories in the U.S. in 2023 (considering data for the largest and leading chains).

The current trends in the coffee shop industry are helping chains gain new visitors and increase frequency. Mid-size coffee brands are starting to climb ranks in the U.S. and abroad.

Competition in the middle market coffee shop industry is increasing considerably. The chains gaining market share are in the know about how to optimize the business using several levers. The most successful leaders are gaining a competitive edge by outworking and out-investing their peers in this dynamic landscape.

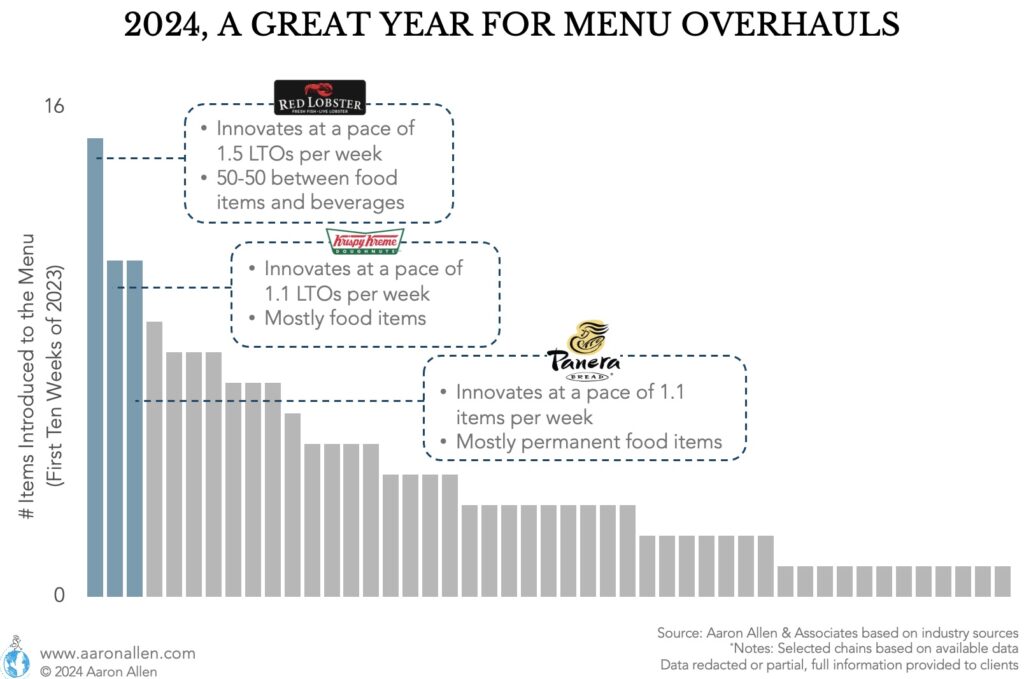

SOME MANAGEMENT TEAMS ARE TACKLING 2024 WITH MENU OVERHAULS…

2024 will be a great year for menu overhauls, not just LTOs. Many restaurants had to trim their menus during COVID and haven’t had a chance yet to make updates or innovate on menu items.

Some of the largest restaurant chains in the U.S. have a consistent cadence when it comes to LTOs. For instance, Red Lobster is introducing an average 1.5 Limited-Time-Offers per week and Krispy Kreme goes at a pace of 1.1 LTOs per week. But others, like Panera, are testing and introducing new permanent items to their menus.

Every great turnaround started with the menu. That’s why new menu launches can’t be relegated to junior teams and need CEO involvement.

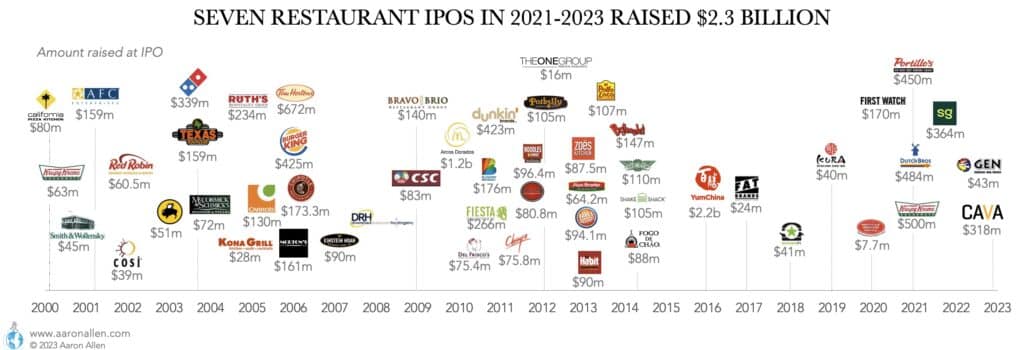

…AND OTHER COMPANIES ARE PREPARING TO GO PUBLIC

The U.S. IPO market has slowed down in the last couple of years: 2022 and 2023 saw the lowest numbers for companies going public in the last decade. But some signs are indicating over the next 12-18 months IPOs are posed to surge.

Investors have many reasons to have faith in restaurant chains. And restaurant IPOs have clear cycles. We think 2024-2025 are going to be big years for restaurant IPOs. And these companies start preparing years in advance.

Because of the similarities with due diligence, companies around the world call us for advice on IPO readiness (for the commercial and operational aspects). It’s best to think about how to maximize value at IPO based on what analysts and investors want to see for top-quartile results and work backwards from there across operational KPIs and functional areas. Auditing the P&L for gaps and opportunities (what will investors see, what will they like and don’t like?), working on TAM and market landscape (do potential investors know about the market and growth prospects?), developing operations-centered models and projections are part of the IPO road that pay off in enterprise value gains.

How We Help You

Aaron Allen & Associates advises restaurant industry operators, investors, and suppliers with clients spanning 6-continents and more than 100 countries. Discover some of our services and the ways we help with: Private Equity, Valuations, Due Diligence, Restaurant Research, Growth & Expansion, Performance Optimization, M&A Advisory, Receiverships, Operating Partner, Hotel F&B, Restaurant Suppliers, Middle East.

Aaron In The News

- Aaron gives his opinion in this profile about Major Food Group (Carbone) and how this dining empire is shaping up.

- In this article about the last days of Boston Market Aaron gives his take on the end of an era in fast casual.

- This article about robot chefs quotes Aaron Allen & Associates research for defining the total addressable market for restaurant robotics.

Join Nearly 300k Global Restaurant Industry Executives and Investors

The Aaron Allen & Associates newsletter is one of the most anticipated weekly reads for those in the know. We cover what’s shaping markets, evolving consumer trends and dining behaviors, and solid strategies for understanding and thriving in the future of foodservice.