Originally published in the Aaron Allen & Associates newsletter on 02/12/2024.

We’ve recently been asked a lot to work as an objective third party to validate new models, speed of operations, new initiatives (from changes in positioning to new prototypes to what geographies to launch into), long-term strategic plans, and brand portfolios.

The value of a restaurant expert, a professional second opinion, cannot be overstated. And no matter what, you will get a second opinion.

Would you rather get an opinion from an expert on how to ensure the initiative is successful or wait for the critics to laugh if it fails (and when it’s too late to reverse course)?

By involving a restaurant expert, you’ll get a fresh lens ensuring the strategies are resilient and forward-looking:

- What are we missing?

- Is the competition already thinking this way?

- Is this the right way to stay ahead?

- Are there potential drawbacks from this approach down the road that we haven’t anticipated?

- Will consumers like it just as much as the management team does?

Internal teams are oftentimes so invested in an initiative they can’t see the “what you don’t know you don’t know” and having an industry expert validate the path helps enrich the planning and execution while reducing the investment risk.

Restaurant Experts Can Help With Concept Validation

If you are launching a new version of your brand, a new format, or in a new geography, we can help:

- Validation of Positioning for a new concept

- Recommendations to validate the Business Case

- Geospatial Analysis to validate a geographic area

- Validation of Drive-Thru design to optimize speed of operations

- Improvements to speed of operations by Straightening Process Flows

Get Expert Support to Define Your Vision of the Future

There are cases when growth has been fueled by incredible customer demand and the approach has been opportunistic, without much time to think about where the company is headed. In those cases, we help:

- Brand differentiation

- Craft a strategy aligned with the company’s values, mission, and heritage

- Assess operations to identify areas of opportunity (avoid reproducing mistakes as the system grows)

- Strategies to achieve greater control and consistency for operational performance

If you have been growing like your hair is on fire but you need help

to answer where should the company be in five years — never mind in ten years, we can help.

Restaurant Chains Struggle to Stabilize Profit Margins

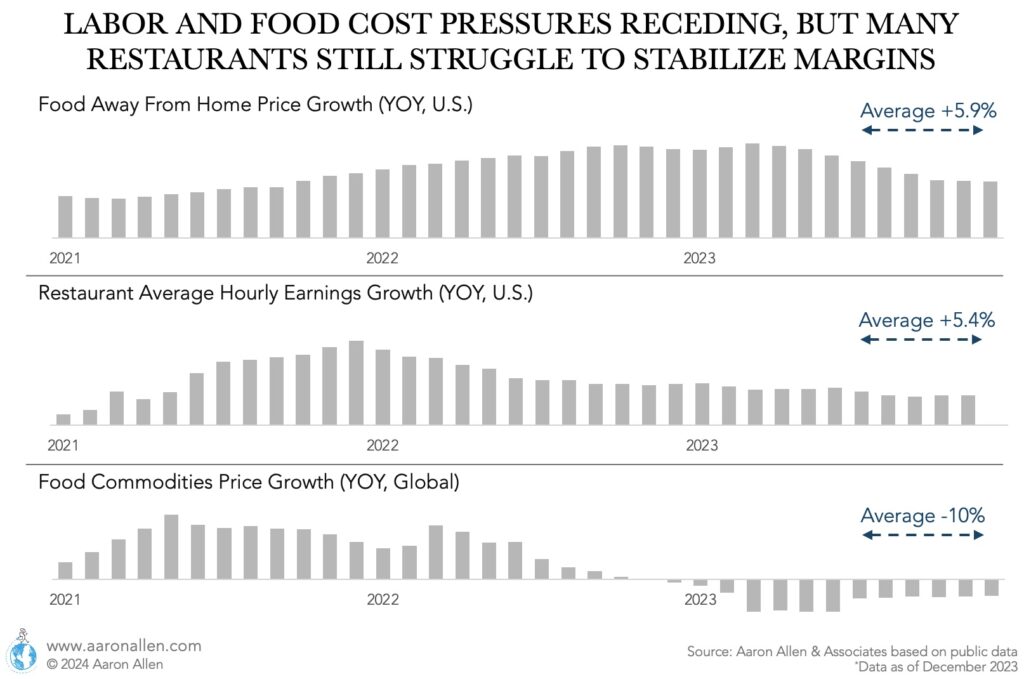

Inflation has recently receded. However, it has been a challenge on margins over so many years that many restaurant chains are struggling to stabilize margins and get to profitability levels that make investors happy.

In this context, the only way to work your way out of inflation is innovation.

This means investments in performance optimization, modernization strategy, delivery and drive-thru strategy, diagnostics, and more are requisite for companies to stay competitive and profitable.

Restaurant Point-of-Sale Companies Rethinking Their Go-to-Market Strategies

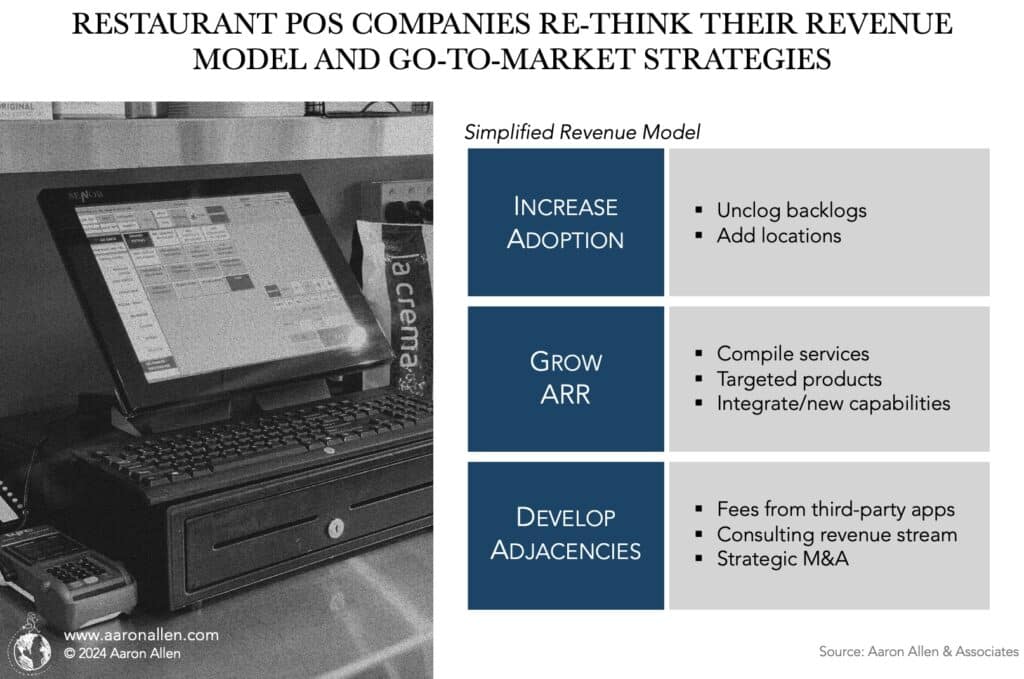

Restaurants have been historically slow to adopt technologies. When it comes to POS systems and back-of-house technology, many are still working with state-of-the-art-2002 legacy systems.

However, investors are taking notice that increasing cost pressures across all major line items are going to force operators to make upgrades or be left behind by both their competition and their consumers. From POS to robotics to commercial kitchen equipment, the landscape is changing and the B2B approaches to get to the end customer are changing as well.

We’ve seen many investors get into the restaurant technology space skipping due diligence and paying the price later.

We Help Investors, Innovators, and Operators with Due Diligence for Restaurant Technology Targets

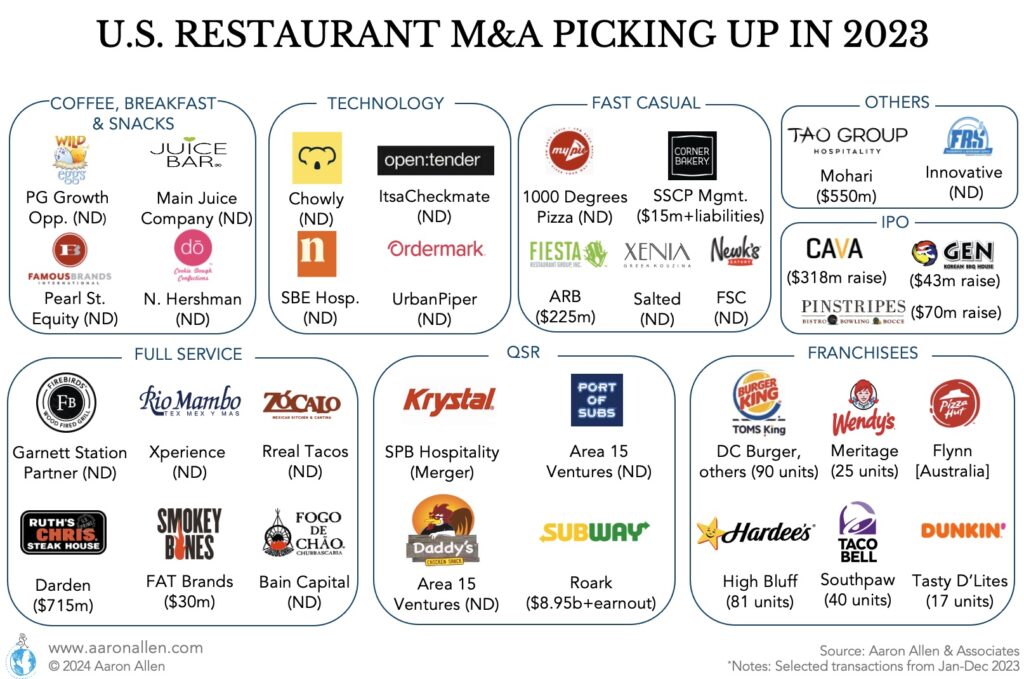

Record-Size Restaurant Transactions in 2023: Will Target Performance Keep Up During the Holding Period? Due Diligence to Get to the Answer

M&A activity surged back in the restaurant industry in the U.S. in 2023. There were a number of acquisitions evenly distributed across segments, from snacks to fast casual to full-service and QSR. There was also a lot of activity among franchisees for QSR brands (including some bankruptcies). And there were some record deals: Subway was acquired for close to $9 billion plus earnout, Ruth’s Chris was sold by $715m, and Tao Group changed owner at an enterprise value of $550m.

If you are evaluating a foodservice acquisition target, no matter if big or small, we recommend you don’t skip due diligence. You will learn if you are paying a fair value and if the asset is likely to generate enough cash flow to re-invest or distribute during the holding period. The process also reveals new perspectives and insight across functional areas (from the efficacy of marketing and brand strength to how the P&L may change under different scenarios) that will contribute to improved business strength and performance.

Need Validation for Growth Strategies for Latin America?

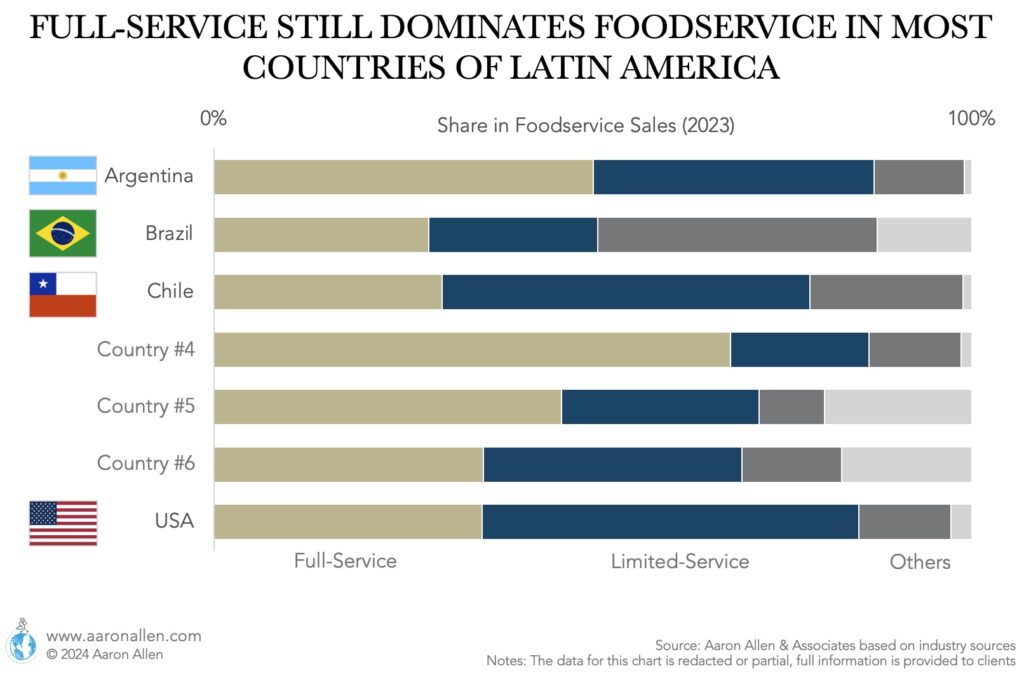

While in mature markets like the USA Limited-Service restaurants dominate the landscape, in most Latin American countries Full-Service restaurants capture the largest share of sales.

And while for much of the landscape there are common trends as markets move from emerging to mature, there still are differences in the pace of growth for emerging categories, evolving purchasing behavior, and the competition in expanding markets.

Seismic shifts are rearranging segments, redefining guests’ expectations around the quality and speed of restaurant experiences, and revolutionizing how meals are ordered, prepared, and delivered. CEOs around the world can learn from what’s worked in other markets and how to best adapt growth strategies for each geography.

We love working with our clients in Latin America!

Join Nearly 300k Global Restaurant Industry Executives and Investors

The Aaron Allen & Associates newsletter is one of the most anticipated weekly reads for those in the know. We cover what’s shaping markets, evolving consumer trends and dining behaviors, and solid strategies for understanding and thriving in the future of foodservice.