Our firm has been active in MENA for more than 15 years, consulting to clients with revenues in the multi-billions, locations in the thousands, stretching across 20+ countries, and with hundreds of thousands of employees in the downstream of the leaders we advise. We are seeing that the HORECA Middle East industry (Hotels, Restaurants, and Catering) continues to grow but in different ways, and operators are having a hard time identifying where the opportunities are.

Economic Growth Will Continue to Shape the Middle East HORECA Landscape

Economic Indicators Encourage Hotel/Restaurant/Catering Sales

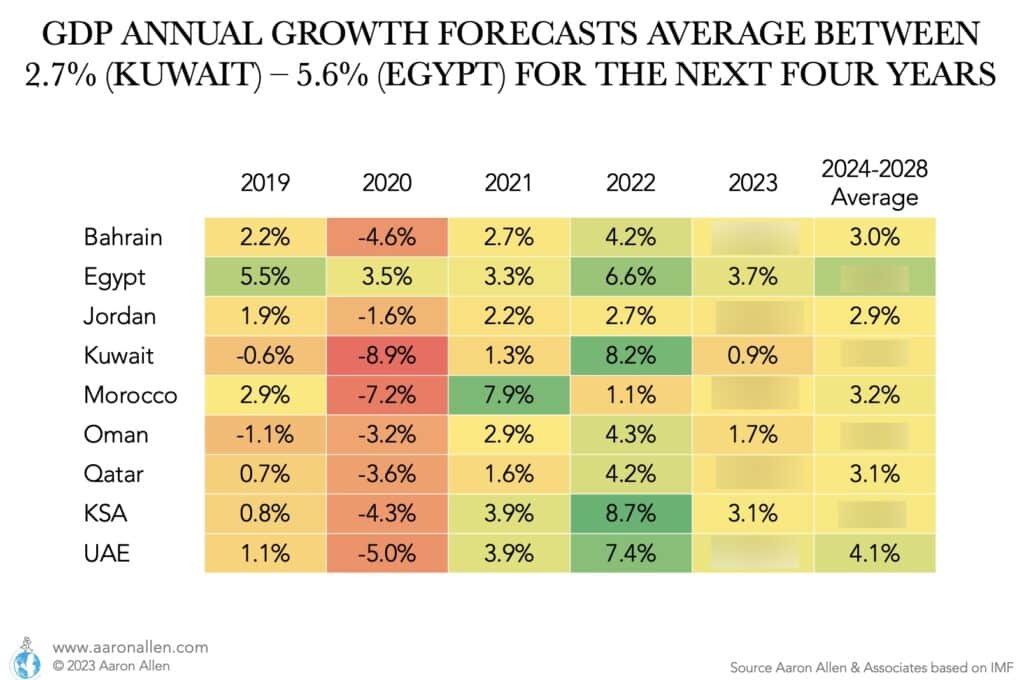

Generally, the HORECA industry grows at the pace of GDP growth, population, inflation, and share of discretionary income. In the Middle East, GDP growth forecasts for 2023 are better than pre-pandemic values for Bahrain, Jordan, Kuwait, Oman, Qatar, the KSA, and the UAE. And forecasts for 2024-2028 are also positive, with Egypt expected to have the highest growth rate, followed by the United Arab Emirates.

These macroeconomic trends are expected to foster activity in the foodservice industry, especially emphasizing the demand side: consumption, tourism, and B2B services.

At the same time, governments are playing an important role with initiatives that complement the development of the HORECA market on the supply side — creating the conditions for investment and labor to be poured into the space. In Abu Dhabi, for instance, a $100 million investment fund was launched (the Abu Dhabi Culinary Investment Fund) to finance a culinary school that would facilitate recruitment and training as well as incentivize top chefs and other institutions to set foot in the Emirate.

Mega Projects Open New Business for Hospitality Firms

Several developments, infrastructure, and state-sponsored diversification projects are unlocking new business opportunities for hospitality companies, from hotels to restaurants to contract foodservice in MENA. Some of these are:

- As part of Vision 2030 in Saudi Arabia, $500 billion are being invested in NEOM across 14 sectors including food, tourism, and entertainment & culture.

- The Red Sea hospitality and tourism project includes 16 hotels offering three thousand rooms — 12 of these hotels are opening in 2023.

- Diriyah is an educational and cultural experience, including also residential, lifestyle, and shopping options in the KSA.

- The UAE continues to build infrastructure, such as the Burj Binghatti in Dubai, set to be the tallest residential tower in the world, with more than 112 floors.

- There are 26 new developments in the UAE in 2023, including the Agri Hub by URB in Dubai, which was designed to tackle food security and provide entertainment.

- The Etihad Rail railway will connect the UAE with the rest of the Gulf. The first passenger station will be in Fujairah.

Saudi Arabia HORECA Sector Gains Dynamism

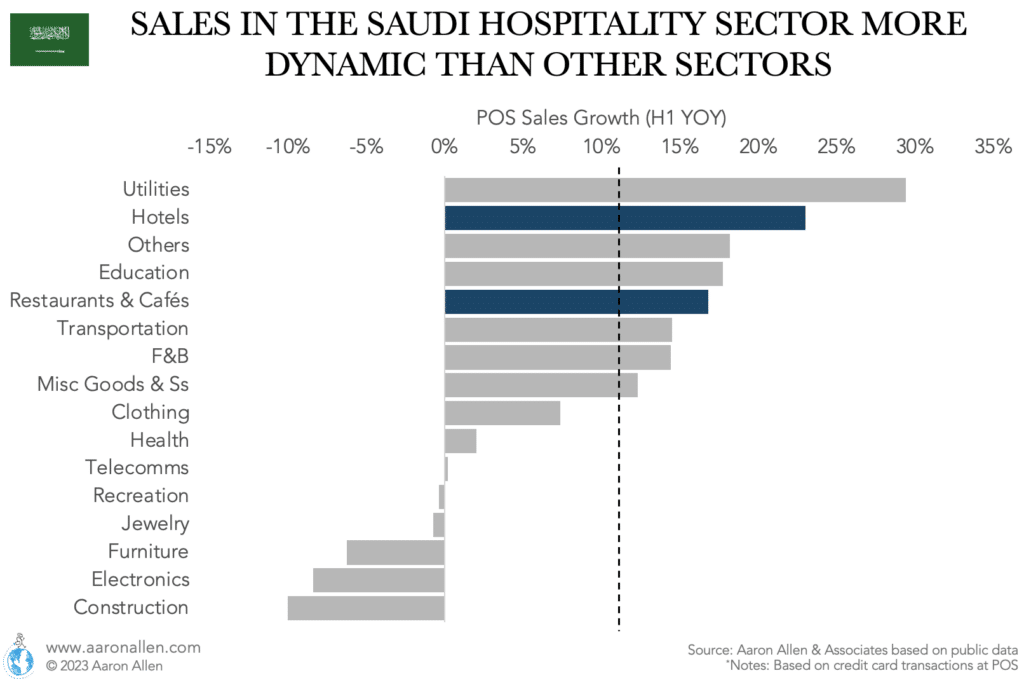

Economic growth, in part fostered by diversification policies and incentives for infrastructure development, has resulted in a more dynamic restaurant industry in the Kingdom of Saudi Arabia.

During the first half of 2023, the hospitality sector in the KSA has grown faster in terms of sales than most other sectors (based on credit card transactions at point-of-sale). Hotel sales grew 23% over 2022, and Restaurants & Cafés grew by 17%.

5 Opportunities in the Middle East HORECA Industry

1-Innovation Will Continue to Drive HORECA Sales

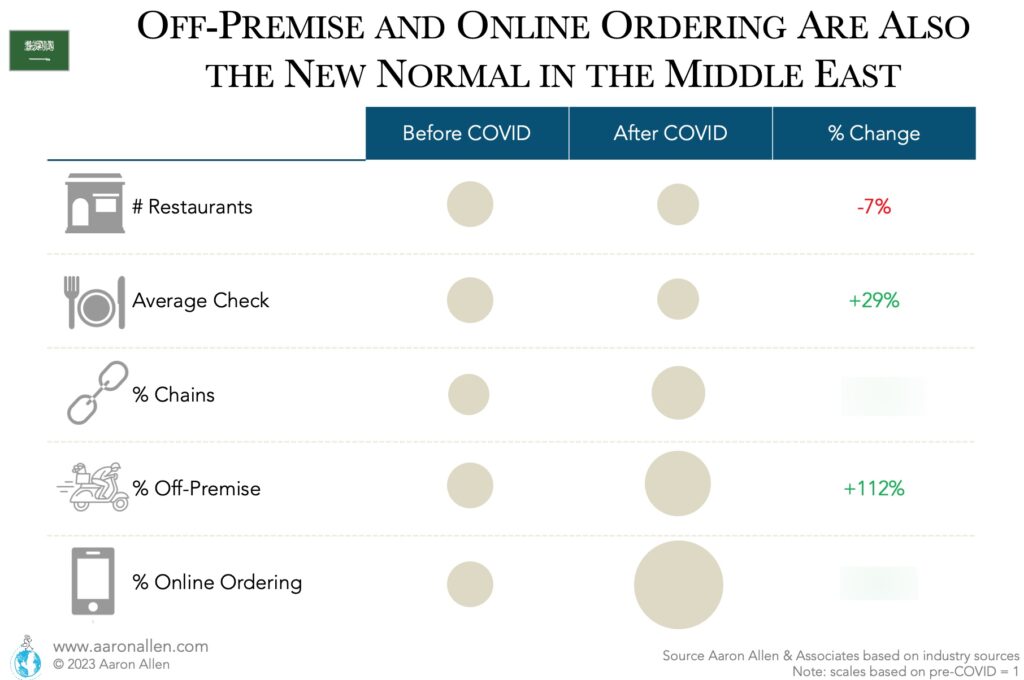

The world has changed after COVID, and those restaurant chains that survived did so by adapting to “the new normal”. The KSA is no exception. In the Kingdom, the number of restaurants shrank by 7% but the share of chains in sales increased by more than 20%. The consumer is twice as likely to order food for off-premise consumption (takeaway, food delivery, or drive-thru), and almost four times as likely to order online as they were before the pandemic.

This is reflected in new players coming into the market, such as Indian-based Rebel Foods which entered the KSA in 2023 with two cloud kitchens. Others are coming in, and existing players are also adopting a more tech-savvy profile.

In the HORECA industry, growth is coming through new channels, and those that can anticipate and make the consumer experience seamless continue to gain market share and stay ahead of the competition from today and tomorrow.

The thought questions require new agility and muscle flex to keep staying ahead.

2-There Are Opportunities in Non-Traditional Restaurant Segments

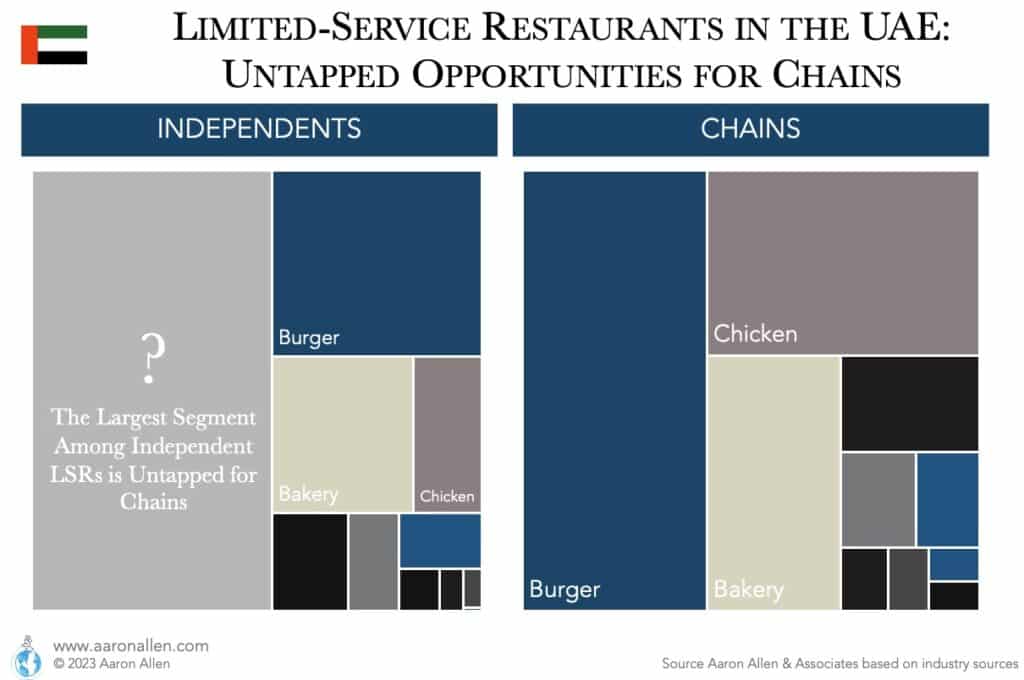

Like in many other countries, Limited-Service Chains in the United Arab Emirates can learn of untapped opportunities by looking at what’s happening with independents. Sometimes, largely successful categories among independents fail to be equally successful as chains because of problems to scale the cuisine or model. Other times, there are just overlooked gaps in the market.

In the UAE, the three largest segments among limited-service restaurant chains (usually overlapping what’s popularly called fast-food) are Burger, Chicken, and Bakery. However, these take the second, fourth, and third place (respectively) among independents, where a different category has a bigger market share.

Even for restaurant groups who have been operating in the country for decades, it’s not always obvious what segments are growing the fastest and where would investments pay off when it comes to brand development or acquisitions. Sometimes it’s necessary an expert, outsider perspective of where the market is going and how a portfolio could be expanded into new categories and segments.

Restaurant Research

3-Consolidation Will Make the Biggest HORECA Groups Even Bigger

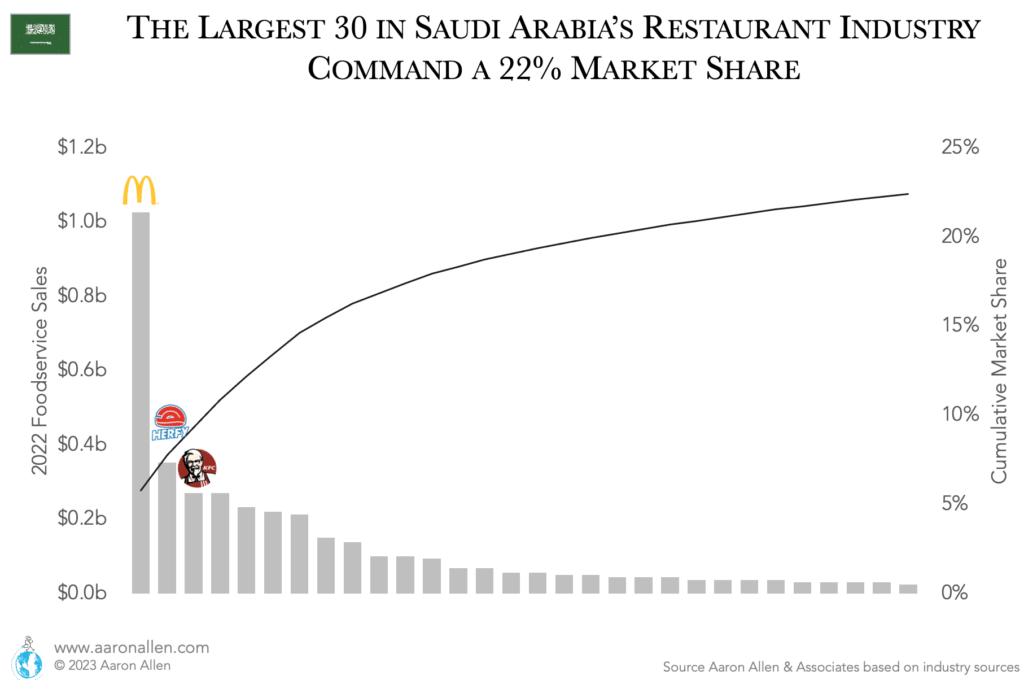

The leading restaurant chains command a larger market share in mature markets like the U.S. and Canada compared to emerging markets in the Middle East like the KSA: in the Kingdom, the top 30 brands account for around 20% of sales, while in North America the top 30 foodservice players are responsible for a third of sales.

We believe what happened in mature markets is going to happen in emerging ones but at an accelerated pace. Market consolidation will continue across the HORECA industry in Saudi Arabia and the Middle East in general — allowing large restaurant groups with a portfolio of brands to get even bigger and take advantage of synergies in SG&A, supply chain, marketing, and technology.

4-Full-Service Chains Playing to Their Strengths Will Be the Ones to Succeed

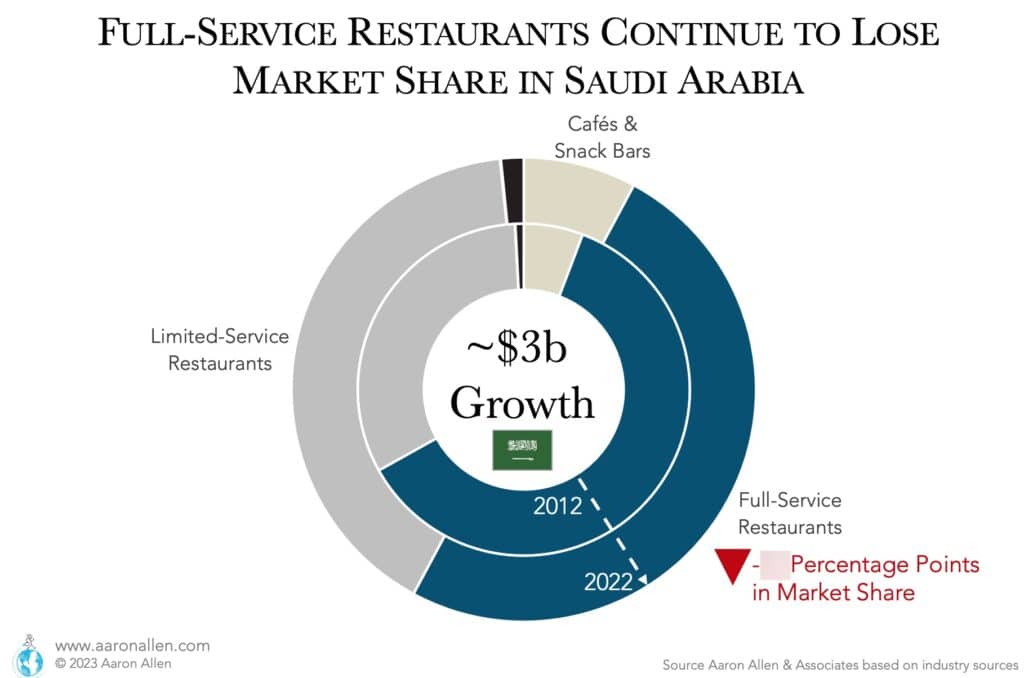

Many Casual Dining restaurant operators have fallen prey to more swift competition and consumers searching for convenience and have been weathering stormy waters for decades now, only made worse through COVID. In the KSA, even though the market is more favorable towards full-service, the category has lost significant market share over the last ten years.

We think the future of full service in the Middle East and globally will diverge into two sectors: on the one hand, traditional casual dining chains struggling to remain relevant will continue to lose market share; and, on the other hand, those able to design an experience that will draw customers out of their couch will gain market share.

5-Foreign Brands Succeeding in the HORECA Market and There Are Also Opportunities to Further Leverage Local Brands

The leaders (by sales) in the Saudi Arabia restaurant industry are McDonald’s, Herfy, and KFC: two Western brands and one large local brand. While many Western brands have long been in the Middle East markets, others are still entering. For instance, Arby’s announced the opening of its first restaurant in Riyadh back in May 2023, with Shahia Foods (master franchisee for Dunkin’) as the local operator; Popeyes and Gulf First announced the development agreement to accelerate growth in the Kingdom back in 2021; and Johnny Rockets partnered with Kitopi (back in 2021) to open 136 restaurants plus 70 ghost kitchens throughout the Middle East.

But not every imported brand will work, and there can be cases where the adaptation to the local market idiosyncrasies fails. For example, IHOP had 17 restaurants in Saudi Arabia but ended up exiting the country in 2020 — though there are plans to re-introduce the concept with a different operator.

At the same time, local brands that are big in one country can potentially be exported to neighboring countries.

The Opportunities in the Middle East HORECA Industry Require Long Range Planning

Whether innovation, growth in untapped segments, inorganic growth, redesigning the guest experience, or expanding by franchising foreign brands, long-range corporate planning is needed to leverage the opportunities in the growing and increasingly competitive Middle East HORECA industry.

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims, specializing in brand strategy, turnarounds, commercial due diligence and value enhancement for leading hospitality companies and private equity firms.

Our clients span six continents and 100+ countries, collectively posting more than $300b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.