Restaurant Cyber Security: How To Prevent Data Breaches

7 Shifts

NOVEMBER 3, 2021

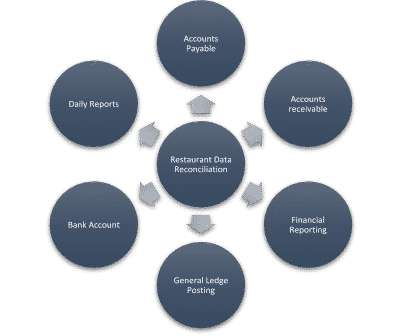

Given the nature of how restaurants operate —with complex systems in the FOH and BOH —ensuring that receive orders, collect payment, and pay teams—here are numerous areas of the business that could be breached. Audit your existing POS and check to see what PCI compliance standards they have. Types of sensitive data in a restaurant.

Let's personalize your content