Additional EIDL Options Available for Small Businesses

2 Min Read

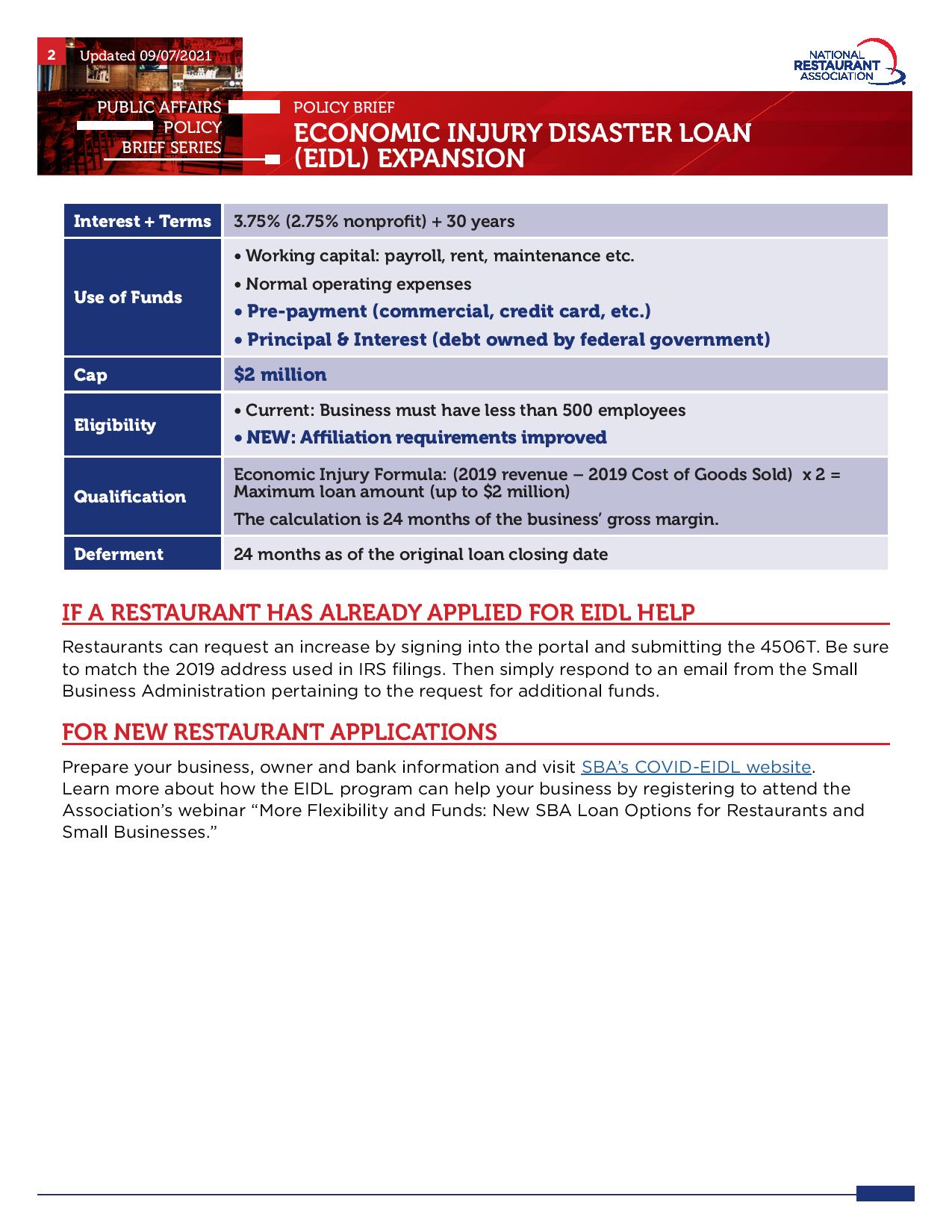

The White House and the U.S. Small Business Administration (SBA) today announced an overhaul to the Economic Injury Disaster Loan (EIDL) program, increasing the loan cap and expanding the ways small business restaurants can use the funds.

The announced changes include:

- An increase in the loan cap amount to $2 million, from a current cap of $500,000. Eligible businesses that have already received an EIDL loan at a smaller loan cap can apply to increase their loan to the max for which they’re eligible based on the SBA calculation.

- Requirements for businesses that are affiliated will now mirror the Restaurant Revitalization Fund.

- EIDL funds can be used to pre-pay business debt, which means that small business restaurants carrying higher-interest commercial debt, or even credit-card debt acquired over the last year, can use an EIDL to pay outstanding balances in one lump sum.

“At a time when there is still an extreme need for small business restaurants to access working capital, these changes will improve the outlook for thousands of operators and will lift the economic outlook for communities small and large,” said Sean Kennedy, executive vice president of Public Policy for the National Restaurant Association. “We worked with the SBA to improve the terms and use of these federal loans so they could be more impactful. The changes we secured will provide an additional rebuilding tool at a time when operators are once again faced with uncertainty.”

The EIDL program is a valuable option for restaurants because the government-backed loans carry a lower interest and are longer term than a commercial bank loan or line of credit. This makes taking on new debt more manageable. Additionally, EIDLs are easier to access for small business owners who may have a hard time securing regular commercial capital.

“We appreciate the efforts of Administer Guzman and the team at the SBA to make these modifications that address the specific needs of restaurants,” said Kennedy. “For owners looking to stabilize their operations, these improved loans come at just the right time.”

As long as funds are available, small business owners have until December 31, 2021, to apply for or increase the amount of an EIDL.

Find more details of the changes to the EIDL program in this fact sheet.