Deliveroo today announced that it’s Australian subsidiary is going into voluntary administration. The company stopped trading on Wednesday. Deliveroo commenced operations in Australia in 2015 and is reported to have had 15,000 workers, although the number of orders each rider was getting was unknown and likely to be low.

Why is Deliveroo leaving Australia now?

The closure of Deliveroo should come as no surprise. It has been described as coming foruth in a two-horse race as far back as 2019. The effect from COVID-19 that the delivery aggregators received in 2020 – 21 did not help, despite increasing orders significantly – but potentially worsening losses, suggesting that the underlying business model is flawed. In fact, it was our prediction that they would close in 2020. COVID impacted the restaurant industry disproportionally hard, especially in Victoria. We believe that the increase in order volume may have seen Deliveroo work on its profitability – but obviously, this was unsuccessful.

The rebound out of COVID has seen a decrease in unemployment. Our research indicates that many saw delivery for Restaurant aggregators – Deliveroo, Menulog, UberEats and DoorDash, as the employers of last resort. Now many people who were riders have gained better employment and performance is likely to have suffered increasing the number of times that a rider can’t be found for an order and the prices that aggregators are forced to pay.

Deliveroo leaving Australia – Impact on Restaurants

Those restaurants that have been able to eke out a living with delivery aggregators will have multiple delivery partners. We suspect that there isn’t one Restaurant in Australia that relied solely on Deliveroo.

Meanwhile, those restaurants managing either pick up only or doing their own deliveries are best placed to prosper. They have higher margins, better quality control and direct access to their customers.

Deliveroo – Impact on riders

The good news is that the impact on riders will be minimal. Most worked for multiple delivery aggregators at once and we assess that with Deliveroo performing so badly, there will be a minimal impact for most riders – they will just get more shifts with other companies.

DoorDash vs Deliveroo

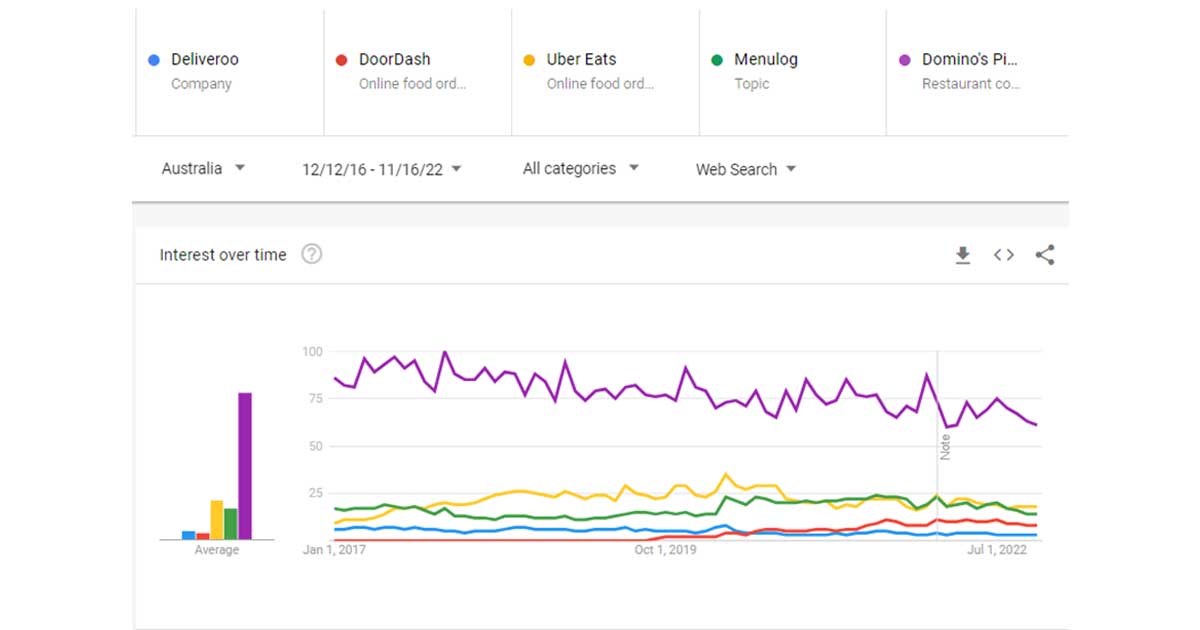

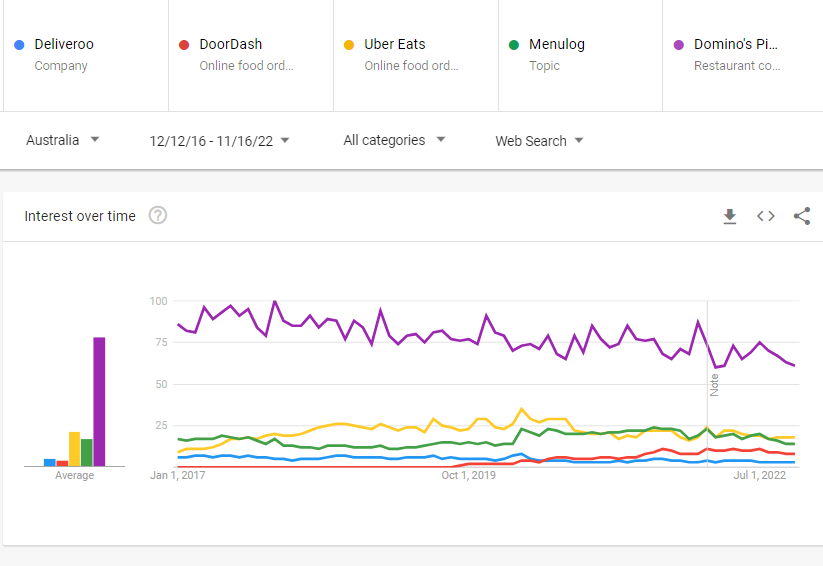

DoorDash started in late 2019, which was a surprised, given the small size of the Australian market. However, it took less than 12 months before there were more searches for DoorDash than for Deliveroo, a sign of just how poor their performance was. DoorDash remains in third place but is gaining on Menulog, a JustEat subsidiary.

Our assessment is that the market is still too small for 3 players and it is likely that either DoorDash or Menulog will shutter in Australia in the next 24 months. This will be more likely if there is legal action around the rights of riders, however the current lack of riders may force the situation with all companies struggling to find enough riders to meet demand.

Domino’s Pizza is still the delivery king in Australia with more people searching for Domino’s than all the delivery aggregators combined!

The fact that Domino’s is financially successful is an indication that maybe the aggregator model is not profitable at all.

Domino’s benefits from better quality control, closer relationships with their customers and it appears cheaper costs.

Deliveroo’s attempts to reach profitability

The share price of Deliveroo since its listing in March 2021. Despite COVID-19 driving a huge increase in restaurant deliveries, Deliveroo was unable to capitalise on the opportunity.

Deliveroo had attempted to increase profitability by diversifying into deliveries of groceries for BP and EzyMart. It is unknown how much revenue this generates, but it is unlikely to have been a significant jump in deliveries.

We believe we will see more restaurants investing in their own delivery infrastructure for 2 reasons.

- It has a closer relationship with the customer.

- Restaurants doing their own delivery are probably more profitable.

This will see those using the aggregators alone slowly dying out and being replaced with Restaurants that put the effort into building their own delivery capability.

Is Poor SEO Killing Your Restaurant?

Too many times we see customers with websites that are costing restaurants thousands of dollars every month through poor design, poor messaging and poor SEO. If your website could be improved to bring in 200 extra visits per month and just 10% of those made a booking, and each booking was for 2.5 seats on average at $50 a seat, you would have an extra $2,500 in revenue a month. A 30% food cost, that is $1,750 in profit extra a month. This ignores those customers coming back as regulars – which is more profit.

Remember, if these customers aren’t finding your Restaurant, they are finding your competitors.

Get one of our obligation free 7 point website SEO audits to see what you can get your web developer to fix to increase your revenue today.