How To Calculate Overhead Costs In 3 Easy Steps

To paraphrase a familiar expression: Nothing is certain but death, taxes, and ov...

At first glance, figuring out how to start a cleaning business may seem like an impossible task. But by breaking the process into simple, easy-to-achieve steps, you can make the impossible possible.

In this article, we discuss how to plan, prepare, and, finally, go to work in your own cleaning business.

When you first set your mind to starting a cleaning business, you may want to jump right in and start scrubbing. There are, however, a number of things you need to do before a rag even touches a surface.

Chief among those things is research. Take the time to learn as much about the cleaning industry as possible, including answers to questions like:

You can find resources and gain experience by reading articles online, talking to people who already work in the cleaning industry, or getting a job at an existing company.

Start thinking about the name for your cleaning business right away. Coming up with a good, descriptive name that isn’t already in use can be tricky and time consuming.

And, it’s not just about setting your business apart from the rest. You’re going to need a business name when you register with local, state, and federal authorities (more on this later).

Once you register your business name and start signing papers for things like insurance and bank accounts, changing the name can be complicated and expensive. Plus, changing the business name after you’ve already started can be confusing for clients.

Do your best to settle on a name before you move into the preparation phase of the process, and then stick with that name until you’ve been up and operational for at least a few years.

Cleaning is a very broad industry that encompasses a long list of activities, including:

There’s no way you can do it all! Instead, narrow your focus to one or two specialties and put all of your resources into those areas.

Then, once you start taking care of clients, keep an eye out for other specialties you can offer and expand into those niches when you have the resources.

After much planning, it’s finally time to make your cleaning business official by registering it with local, state, and federal authorities.

As we mentioned earlier, you’ll likely have to register the name you chose as well as a business structure for tax purposes.

Options for this latter detail include:

Depending on how many people are running the company, most new businesses will likely choose one of the first three arrangements. That said, it never hurts to consult an attorney or a tax professional for help deciding which option is right for you.

The more you learn about how to start a cleaning business, the more you’ll see just how important business insurance is to first-time owner/operators.

You and your employees are going to be interacting with your customer’s property. What happens if you break a window, an antique, or a computer?

Your business will have to reimburse the customer for that item. And, depending on the extent of the damage, the associated costs could take a big bite out of your bottom line (or cause you to close your doors completely).

Instead, an insurance policy could be that your business pays a yearly fee to the insurance company and they agree to cover any damages that may occur in the line of normal operations up to a certain dollar amount.

While it’s not unheard of to use the same account for business and personal funds, most new operations will want to keep those two streams of income and expenses separate.

Having an account for business assets and an account for personal assets can help make recordkeeping, payroll, and taxes much easier to manage and maintain.

With separate accounts, you won’t have to spend hours come tax time trying to figure out what income and expenses were personal and what income and expenses were for the business.

Once you’ve completed all the necessary paperwork, you can get to work on the day-to-day operations of your cleaning business.

One of the first things you’ll want to do is decide on a rate for your services.

That means more than just deciding that you want to pay yourself or your team members $30 an hour. You’ve also got to factor in other business expenses, such as taxes, supplies, and at least a little profit.

For example, start with the $30 an hour number and then add in one or more of the following percentages to reach your final hourly rate:

Keep in mind that these are just suggestions — your business may need to include other expenses in the hourly rate, so feel free to customize the numbers to fit your operation.

If you’re unsure about what to factor into your rate and what the percentages should be, talk to an attorney or an accounting professional.

While you may not need a written budget right away, sooner or later it will come in very handy for helping you turn a profit.

If you don’t monitor what you spend for things like chemicals, rags, work clothes, tools, and the like, you could find yourself blowing through all the profits.

To prevent this, build a budget and do your best to stick with it.

The final step in starting a cleaning business is to advertise your operation to potential customers.

As you consider how to go about advertising, keep in mind that you don’t have to spend a bundle on traditional sources like TV, radio, and print. There are plenty of free and inexpensive ways to get your name out there.

Post flyers on local bulletin boards. Build a free website. Start a Facebook page. Hand out your business card to everyone you meet. Ask family and friends to spread the word.

Get creative with your advertising and your efforts may pay off with an influx of customers.

Depending on the specialty you choose, learning how to start a cleaning business doesn’t have to be complicated. And starting that business doesn’t require a lot of fancy software — but some can help you manage your activities better.

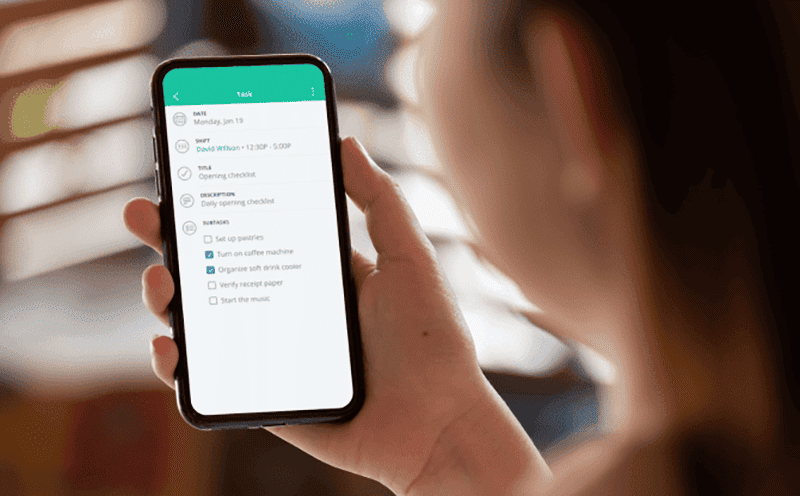

Once you get rolling, you’ll likely need to keep track of appointment times, locations, what needs to be done for each client, the supplies you’ll need to take with you, and other details that you may not be able to remember all on your own.

If you hire employees right away, things become even more complicated.

But with help from the Sling suite of workforce management and scheduling software tools, you’ll be better positioned to keep track of all the little details that are vital for your success — especially as your business starts to grow.

Try the Sling app for free today and then visit our blog to get even more free resources to help you manage your cleaning business better, organize and schedule your team, and track and calculate labor costs.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.