The global coffee industry has a total addressable market of more than $400 billion (annual sales). Of that, about $8 in every $10 are spent in Coffee Away From Home (coffee shops, kiosks, vending machines, etc.)

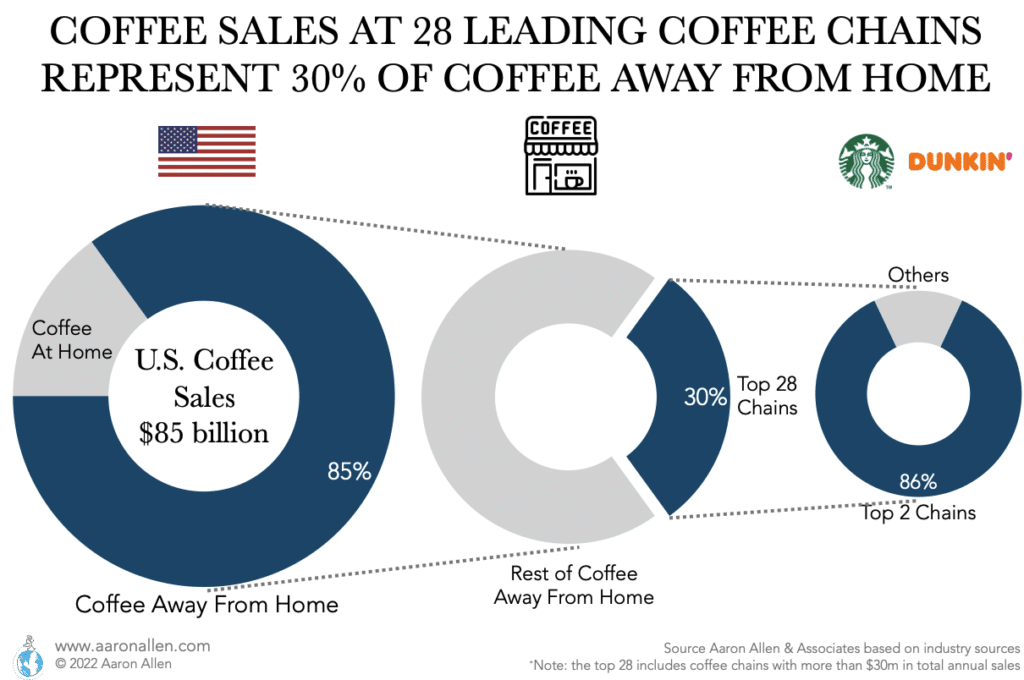

The United States coffee industry reaches $85 billion in annual sales — 20% of the global coffee market. The coffee shop industry is the third largest restaurant category in the U.S., with 11% of sales among the largest 200 chains and growing significantly faster than the two leading categories (LSR Burger and Full-Service Restaurants).

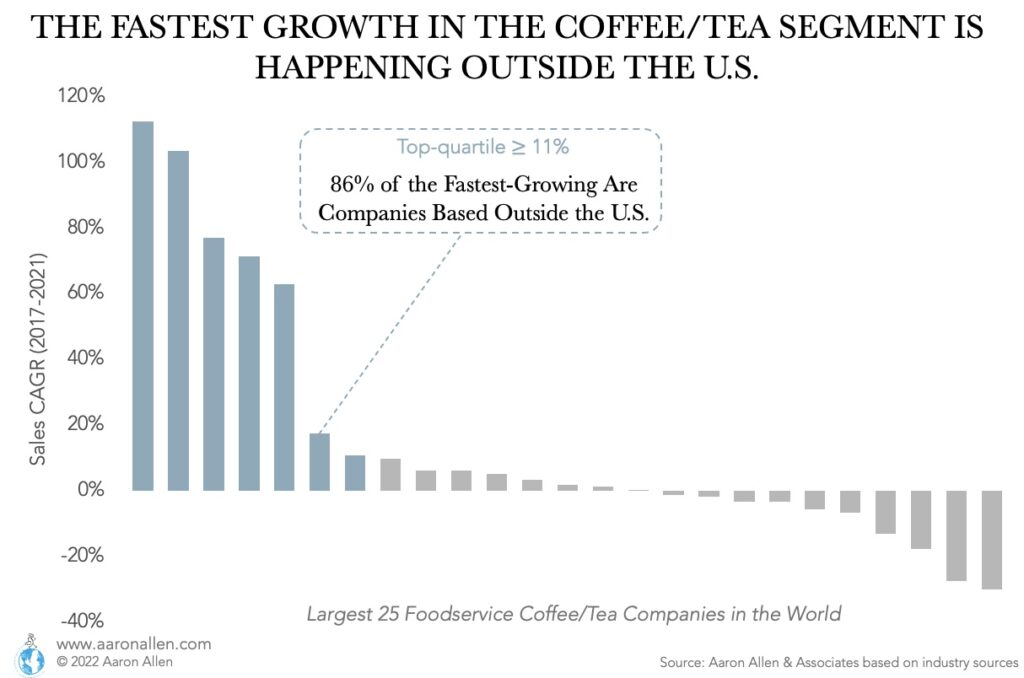

The coffee industry is forecasted to grow at mid-single digit rates for the next few years and growth is expected to be faster in international markets than in the U.S.

Coffee Trends Driving Sales in Coffee Shops

The current trends in the coffee shop industry are helping chains gain new visitors and increase frequency — restaurant CEOs are quickly making moves to stay ahead.

Iced Coffee Is Displacing Hot Beverages

Iced coffee like nitro cold brew and iced espressos are sustaining sales in some of the largest coffee chains. In Starbucks, 75% of beverage sales are cold (as of 2022).

Nitro Cold Brew Continues to Gain Traction

Nitrogen can be added to coffee to make it smoother and bring up the natural sweetness in coffee. This coffee drink is usually served chilled but without ice. The global nitrogenated coffee market is estimated to surpass the $25 million as of 2022 and continue to grow, partially propelled by consumers looking for less sugary drinks, and also because the flavor can be customized (vanilla being the most popular nitro cold brew adaptation). Coffee chains like Starbucks, Dunkin’ and Dutch Bros all serve nitro cold-brew options.

Edible Coffee Is Still a Novelty

Coffee is becoming present outside the drinks space. Coffee sriracha is a condiment, brands like Espresso Bites have developed coffee bars as snacks, and there are even coffee-flavored candy bars.

Dalgona Coffee Is Bringing Back Instant Coffee

Dalgona is a whipped instant coffee with sugar that reproduces the taste of honeycomb toffee and the texture of whipped cream. It can be served with ice and milk.

Canned or Bottled Coffee

Ready-to-drink coffee options are becoming more popular, especially in grocery stores and convenience stores as they represent a fast and convenient way to drink coffee. Starbucks and Dunkin’ already have options for ready-to-drink options.

Non-Dairy, Plant-Based Ingredients Are Making Its Way Towards the Coffee Industry

6% of U.S. consumers are vegan, excluding dairy from their diets. This and other health trends are boosting the consumption of dairy alternatives — a market valued at more than 25 billion globally as of 2022. Almond milk, soy milk, and coconut milk are some of the most common milk replacements consumers can get at any coffee shop these days.

Matcha Lattes Are a Coffee Alternative With Less Caffeine

Matchas are made with green tea, milk, and water. They are a slightly healthier option to coffee as they contain less caffeine, some fiber and antioxidants.

Mid-Size Coffee Brands Are Starting to Climb Ranks

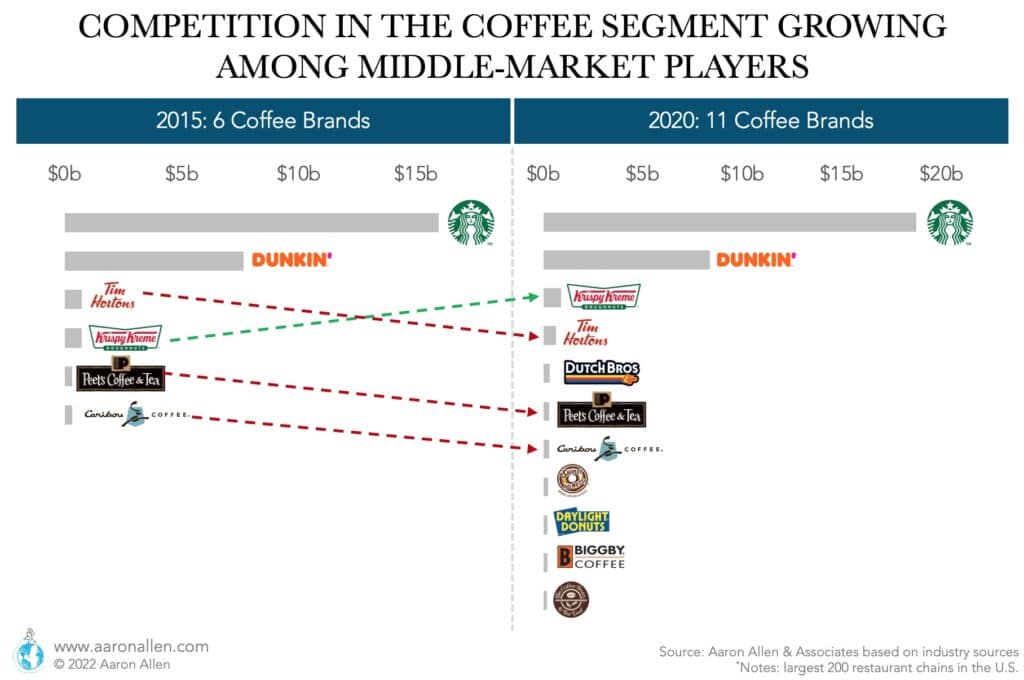

Competition in the middle market coffee shop industry is increasing considerably, with a notable number of brands making it to the largest 200 U.S. restaurant chains. While there were six brands in the rank back in 2015, the number grew to 11 in 2020. Dutch Bros, for example, expanded notably, going from not being in the radar in 2015 to becoming the fifth largest coffee chain in the U.S. in 2020. The chains gaining market share are in the know about how to optimize the business using several levers.

We Help Companies Growth and Expand in the Coffee Segment

The Coffee Shop Industry is Highly Dominated by Two Coffee Chains

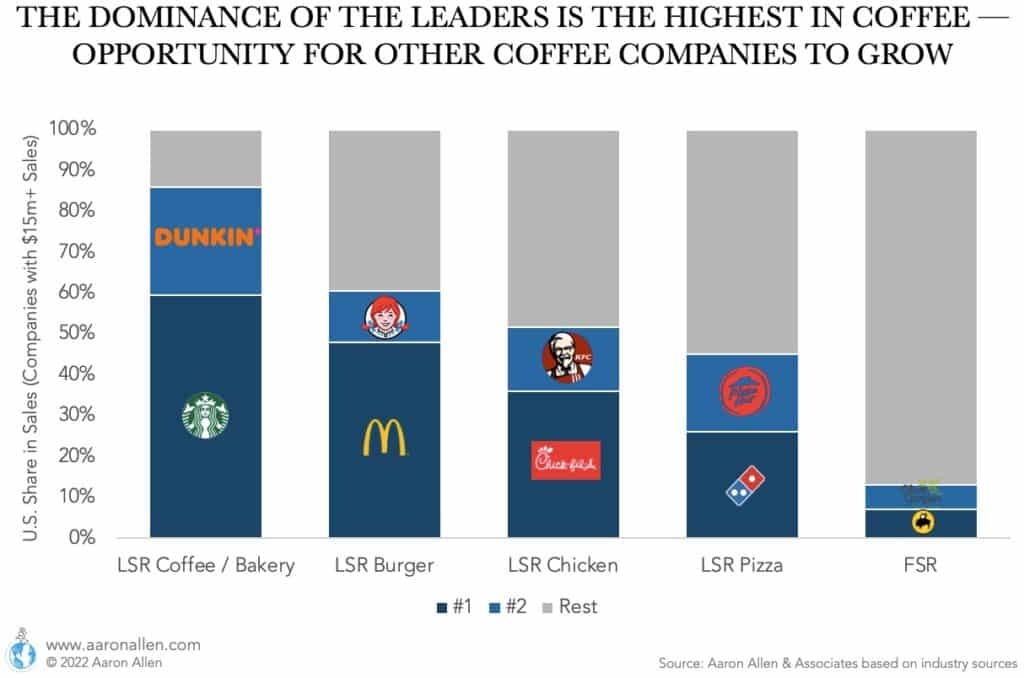

The foodservice coffee segment is one of the most concentrated in the restaurant industry, in terms of market power. Considering U.S. companies with more than $15 million in sales, the market share of the two leaders gets to 86% for coffee (of $31.5 billion in sales across almost 30 companies), compared to 60% in burger, 52% in chicken, and 45% in pizza.

With the U.S. representing 20% of the global coffee market, the opportunity for other coffee companies to grow and claim share from American chains like Starbucks and Dunkin’ is significant. These are no longer the infallible leaders they used to be.

Whether via organic or inorganic growth, coffee offers plenty of possibilities in developed and emerging markets.

Considering an Acquisition in the Coffee Category?

The World’s Leading Coffee Brands Are Growing Fast

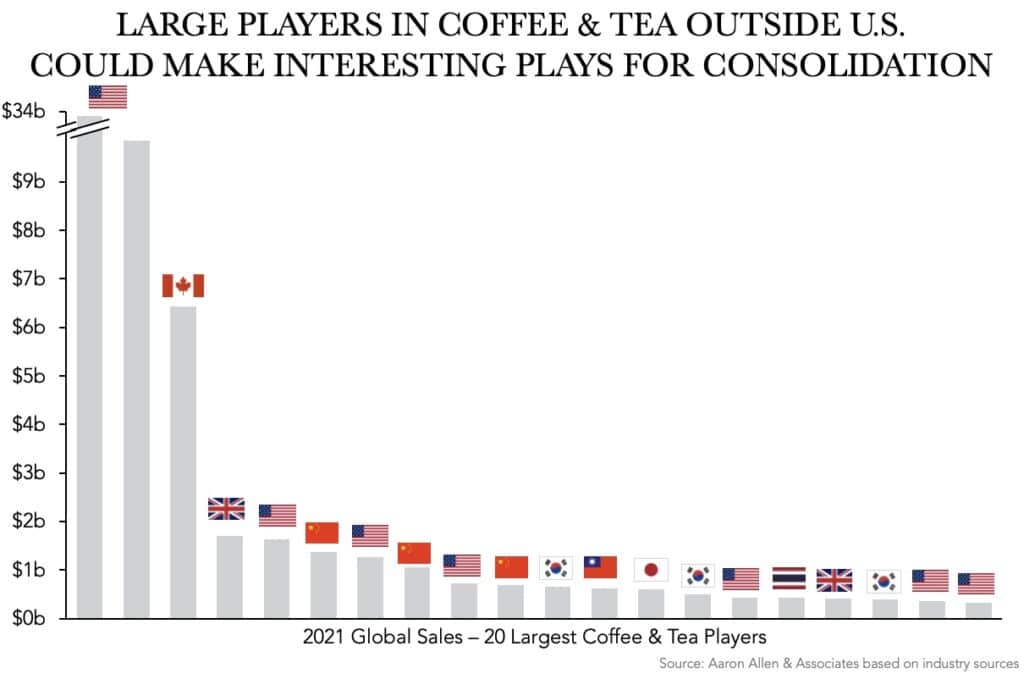

The opportunities in the coffee shop industry are not limited to the U.S. In fact, of the 20 largest coffee brands and tea players globally, 60% are headquartered outside the U.S.

Almost half of the leading 20 coffee chains are coming from Asia (China, South Korea, Japan, and Taiwan).

- Largest coffee chains based in the United States: Starbucks, Dunkin’, McCafé, Krispy Kreme, Tropical Smoothie Café, The Coffee Bean & Tea Leaf (acquired by Jollibee Foods), Caribou Coffee, and Dutch Bros Coffee

- Largest coffee chains in Asia: Heytea, Luckin Coffee, Nayuki (all three based in China), A Twosome Place (South Korea), Komeda Coffe Ten (Taiwan)

- Largest coffee brands in Europe: Costa Coffee and Caffe Nero (both based in the UK)

The 25 largest foodservice coffee/tea companies globally represent $57b in annual sales. The top-quartile (those with the fastest growth) have a CAGR that surpasses 11%. And of those fastest-growing companies, 86% are outside the U.S. and many are experimenting with alternative foodservice formats.

Starbucks is the Largest Coffee Brand in the World

Starbucks has more than 34 thousand stores globally (as of 2022), about half of that in the U.S. The company has grown with corporate coffee shops as well as licensing, and it also has a FMCG arm in partnership with Nestlé (that markets Starbucks coffee products in grocery stores since a licensing deal was brokered for $7 billion in 20218). One of the key pillars for Starbucks growth has to do with customer-centric innovations.

Dunkin’ is the Second Largest Coffee Chain

Dunkin’ has more than 11 thousand stores globally (as of 2022), with about three-quarters of the system based in the U.S. and the rest franchised across more than 35 countries. The first Dunkin’ opened back in 1950 and serves more than 50 different donut flavors. The company was acquired in 2020 by Inspire Brands for $11.3 billion.

McCafé Leverages the McDonald’s System to Sell Coffee

The first McCafé opened in Australia in 1993 and now there are more than 5,300 stores globally. It’s a more affordable alternative than a coffee from Starbucks.

Krispy Kreme Donuts Foster a Higher Value of Sales

Krispy Kreme was established in 1937 and counts with 1,350 stores in over 25 countries. While the company sells coffee, a significant share of sales come from donuts, which gives Krispy Kreme an advantage and the highest average sales per unit of the coffee chains.

Chinese Hey Tea Among the Fastest-Growing Coffee and Tea Chains in the World

Hey Tea was founded in 2012 and already has more than 800 stores (as of 2022). The company sells “new style tea” drinks made with salty cream and a variety of toppings.

Luckin Coffee Continues to Grow in Asia

Luckin Coffee was founded in 2017 in China and counts with 7,200 stores (69% corporate – 31% partnership stores). The company serves coffee and other products, and has a mix of pick-up stores, delivery kitchens, and “relax stores”. Luckin prides itself on having a tech-focus that enables it to optimize the customer journey. At one point the company was valued at $12.7 billion but this declined after it was discovered sales figures had been manipulated.

Costa Coffee Has a Strong Presence in the UK

Costa Coffee was established in London in 1971 and counts with more than 4 thousand stores as of 2022 in 32 markets, as well as 10 thousand Smart Café self-contained automated coffee kiosks.

Caffe Nero

Caffe Nero was founded in 1997 in the UK. As of 2022, the company has more than 750 stores.

The global coffee industry has a total addressable market of more than $400 billion (annual sales). Of that, about 80% is spent in Coffee Away From Home (coffee shops, kiosks, vending machines, etc.)

Some of the biggest trends in the coffee industry as of 2022 include iced coffee, nitro cold brew coffee, dalgona coffee, bottled coffee, matcha lattes, and non-dairy plant-based milk and cream substitutes.

The United States coffee industry is $85 billion in annual sales — 20% of the global coffee market. Within that, the coffee shop industry represents more than $70 billion.

Yes, the coffee industry is forecasted to grow at mid-single digit rates for the next few years and growth is expected to be faster in international markets than in the U.S.

About Aaron Allen & Associates

Aaron Allen & Associates works alongside senior executives of the world’s leading foodservice and hospitality companies to help them solve their most complex challenges and achieve their most ambitious aims, specializing in brand strategy, turnarounds, commercial due diligence and value enhancement for leading hospitality companies and private equity firms.

Our clients span six continents and 100+ countries, collectively posting more than $300b in revenue. Across 2,000+ engagements, we’ve worked in nearly every geography, category, cuisine, segment, operating model, ownership type, and phase of the business life cycle.