What Is Payroll Tax: Everything Employers Need To Know

What is payroll tax? At first glance, payroll tax can be confusing and opaque fo...

Did you know there’s a classification between an employee and an independent contractor? The IRS calls it a statutory employee, and designating your staff as such could have benefits for both your employee and your business.

In this article, the workforce management experts at Sling introduce you to this unique employee classification and give you tips for managing them in your business.

A statutory employee is an independent contractor that you treat as a special type of full employee for tax withholding purposes if they meet certain criteria.

For a full employee, your business pays half of the Social Security and Medicare (FICA) taxes while the employee pays the other half.

For an independent contractor, they must pay the full amount of the Social Security and Medicare taxes. The benefit of being an independent contractor comes from being able to deduct their expenses on Form 1040, Schedule C.

A statutory employee enjoys the best of both worlds. They only pay half of the Social Security and Medicare taxes (your business pays the other half) while also being able to deduct any expenses they incur while pursuing the work for your business.

According to the IRS, a driver is a statutory employee if they distribute meat products, vegetable products, fruit products, bakery products, or beverages (other than milk) or pick up or deliver laundry or dry-cleaning for a specific business.

To be classified as a statutory employee driver, the individual must:

A full-time life insurance sales agent is often classified as a statutory employee because their main business activity is selling annuity contracts, life insurance (or both), for one insurance company.

The salesperson may use office space you provide, as well as secretarial resources and company materials, but they may also furnish their own space, hire their own staff, and purchase their own materials.

In most cases, you cannot classify a salesperson as a statutory employee unless:

A home worker (a.k.a. a piece worker) is a statutory employee if they perform work for your business on materials or goods you provide and according to your business’s specifications.

In addition, the name “home worker” is a bit misleading. The place where the home worker performs their job does not have to qualify for the home office deduction in IRS code Section 280A (the typical definition of a home worker).

In fact, the statutory employee doesn’t even have to perform the service at their home. It is really only necessary for the employee to perform the service away from your business to be classified as a home worker.

Another example of a statutory employee is a full-time traveling salesperson (or city salesperson) who acts as your representative and turns in orders to your business from:

Similar to the insurance salesperson, you cannot classify a traveling salesperson as a statutory employee if they solicit the majority of their orders for a business other than yours.

Regardless of whether you classify your team members as full employees, statutory employees, or independent contractors, it’s essential that you talk to a tax professional who is well-versed in the type of business you run.

There are many ins and outs to the U.S. Tax Code, and you want to make sure your business is always on the right side of said laws.

A second option is to outsource your payroll operations to a third-party service. They will know how to handle even the most complicated withholding schedule so you don’t have to worry about it.

When hiring a statutory employee, always provide a contract that details their employment status along with the type of employee/employer relationship they are entering into.

A clear contract helps delineate the responsibilities that you have, as well as the responsibilities that they have.

If you don’t have experience drawing up contracts, consider consulting a lawyer who is experienced with businesses in your niche.

Determine how you will pay a statutory employee before you hire them.

For example, if you employ a statutory employee as a salesperson in your retail business, you may choose to pay them with commission on every sale.

Alternatively, you may choose to pay them for each piece they sell or produce (depending on the type of retail business you run).

Whatever system you choose, agree on an arrangement that benefits both parties so your statutory employee doesn’t become disgruntled and create a toxic environment in your business.

In the eyes of the IRS, a statutory employee is a unique hybrid of the full employee and the independent contractor. As such, your business will pay a portion of their Social Security and Medicare taxes while they pay the difference.

The goal throughout the year is to withhold enough — and make regular estimated payments — so that you won’t owe the IRS anything come tax time.

This is not always easy to do, but a tax professional can help you set up a schedule so that your tax burden at the end of the year will be less.

If your statutory employee doesn’t know to withhold FICA taxes as well, they could be stuck with an unexpected tax bill at the end of the fiscal year.

Make sure you inform them explicitly that they are responsible for a portion of the Social Security and Medicare taxes so there is no confusion about who is paying what.

Keeping track of your statutory employees’ hours can be difficult, but it’s essential to do it right so you comply with the tax codes and avoid unnecessary fines.

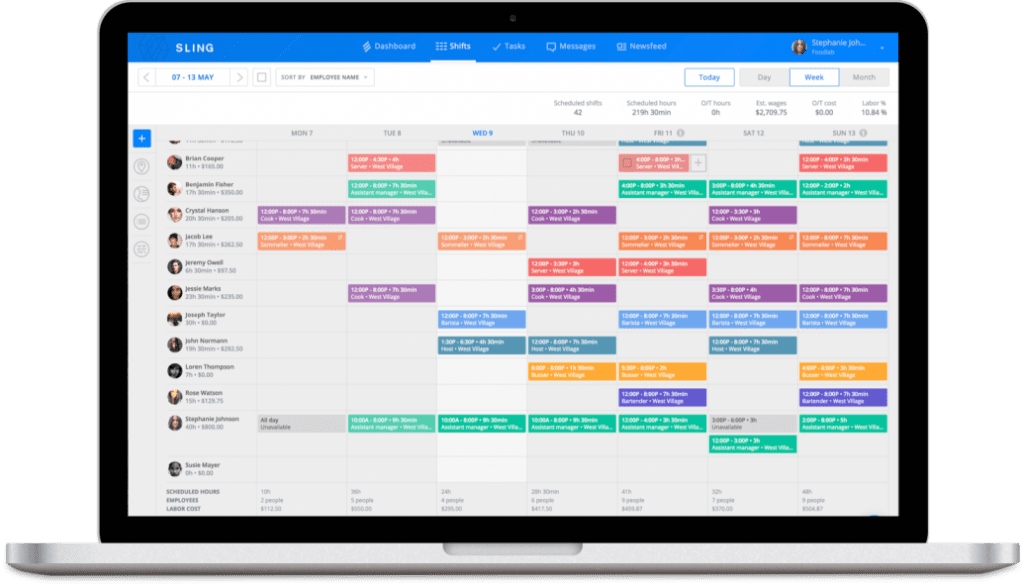

One of the best ways to make the process easier is to use a scheduling tool like Sling.

The Sling app is designed specifically for tracking and scheduling your employees — statutory or otherwise — so all of its tools are dedicated to that task.

Sling’s user-friendly interface makes it easy to see how many hours each employee will work or has worked every week and gives you notifications of overlapping shifts and double-bookings so you can avoid problems.

Sling also brings together two additional toolsets to make your work life easier: time tracking and labor cost control.

During the workweek, Sling’s unique time-tracking features allow you to turn any phone, tablet, or computer into a fully-functional time clock that your employees can use to clock in and out.

At the end of the workweek, just a few clicks or taps is all it takes to export your statutory employees’ timesheets for payroll processing.

Simply review the timesheets, edit and approve, and then send them to your choice of third-party program for seamless payroll calculation and distribution.

You can then go back and use Sling’s labor cost tools to measure, manage, and optimize your spending as you create the next schedule.

No more endless revisions trying to squeeze all the shifts and work necessary under your existing budget. One pass through the schedule and you’ll know if you’ve exceeded your labor costs or not. Then it’s just a few clicks here and there to bring your spending back into the black.

Sling even provides features that help you distribute your schedule efficiently, keep it up to date, find substitutes, and communicate with your employees.

It’s a turn-key solution for all of your workforce management and optimization needs (whether you hire statutory employees or not). Try the app today for free and see what worry-free scheduling is all about.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.