Exempt Vs. Non-Exempt Employees: What’s The Difference?

Deciding how to classify exempt vs. non-exempt employees can be confusing at fir...

Putting FLSA exempt employees on your payroll can have a significant impact on your business’s bottom line.

But what exactly is an FLSA exempt employee? What other options are there? And what are the pros and cons of choosing exempt over another classification?

In this article, the workforce-management experts at Sling will discuss those questions and tell you everything you need to know to make the right decision for your business.

In the early to mid-1900s, businesses had unilateral control over their employees’ schedules, wages, and a whole host of other variables.

Then, in 1940, the federal government enacted the Fair Labor Standards Act (FLSA) to set limits and standards on the way businesses managed their employees. The biggest change to come with the FLSA was how many hours employees could work each week.

Businesses could now only require their employees to work a maximum of 40 hours per week (e.g., eight hours per day, five days per week).

If the employees worked more than 40 hours per week, the business was to pay them extra compensation that came to be known as overtime.

The FLSA also addressed other significant variables in the employer/employee relationship, but it’s the overtime issue (and the way you compensate your team) that is at the heart of the decision to classify individuals as FLSA exempt employees.

We’re discussing what managers need to know about FLSA exempt employees in order to make an informed decision for their business. But to truly understand the exempt status, you also have to understand its counterpart: non-exempt status.

According to the Fair Labor Standards Act, a non-exempt employee in a private business is one who meets the following criteria:

Because non-exempt employees are typically paid by the hour (meaning they clock in and clock out every day) — and are often paid less than FLSA exempt employees — non-exempt employees qualify for overtime.

Whether you hire full-time or part-time employees, if you classify them as non-exempt, you have to pay them at least minimum wage, and, if they work more than 40 hours a week, you have to pay them overtime.

On the other side of the coin, an FLSA exempt employee in a private business is one who meets the following criteria:

Because these employees receive a salary (meaning they are paid a flat amount whether they work 40 hours or not), exempt employees do not qualify for overtime.

Before you add employees to your payroll structure (be they FLSA exempt or non-exempt), talk to a lawyer about how each classification will affect your business.

Calculating overtime can get very complicated very quickly.

But with FLSA exempt employees, you don’t have to worry about elaborate formulas because you pay the individual the same amount every pay period regardless of the number of hours they work.

Your business may offer comp time as a way to compensate exempt employees who put in extra time at the office, but this benefit is often easier to track and control than overtime.

If you classify all of your employees as FLSA exempt, your labor cost projections will be much easier to calculate.

This is because you know exactly what you’re going to pay your workforce each pay period. You won’t have any surprises because of unplanned overtime and other unforeseen expenses that impact your bottom line.

The variables we discussed above, as well as others, make FLSA exempt payroll much easier to calculate and administer.

Your HR department doesn’t have to spend hours — sometimes even days — crunching numbers in order to cut checks for your employees.

There are fewer pay fluctuations, so they write the same check every pay period. Under those conditions, the process becomes much more streamlined and efficient.

The lack of formal hour tracking with FLSA exempt employees means that some may work less than 40 hours a week now and then.

This usually doesn’t become an issue because those same employees may work more than 40 hours some weeks in response to increased business or a big project.

For the most part, if you require your employees to be at work between two periods of time (e.g., from 8 a.m. to 5 p.m.), their total annual time worked will average out to 40 hours per week.

When you pay your employees a set salary (as those classified as FLSA exempt typically are), it’s often easier for them to arrive late and leave early without management noticing.

This is because they are not required to clock in when they arrive at work in the morning, nor are they required to clock out when they leave work in the evening.

Even five or six minutes of late arrival/early departure each day (e.g., 30 minutes per week) can quickly add up to 20 or more hours of lost work time every year.

With FLSA exempt employees, it can be difficult for your HR department to track performance without regular reviews.

We recommend scheduling employee evaluations at least once a year, but we will also mention that every six months (twice a year) is better, and every three months (four times a year) is best.

Choose a review schedule that works for your business and use it to keep track of how your FLSA exempt employees are doing in their respective jobs.

You can even apply the performance review schedule to your non-exempt employees to keep their skills, focus, and productivity up to your business’s high standards.

Classifying your employees as exempt or non-exempt is an important decision for your business. It will directly affect your business’s bottom line.

You can, however, control (and even minimize) how much of an impact each of those classifications has by managing, organizing, and optimizing your workforce.

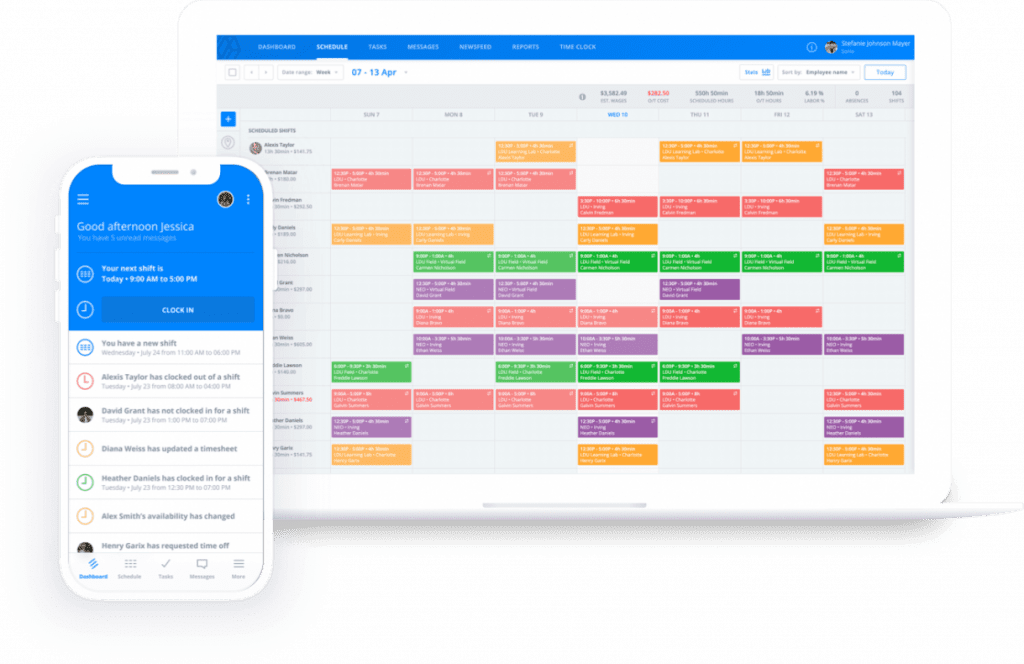

And the best way to do that is with modern scheduling and workforce management software such as Sling. The Sling app, in fact, is the best choice to help you manage all aspects of your business.

First and foremost, Sling gives you unprecedented control over your scheduling process.

With the cloud-based tools that Sling offers, you can implement employee self-scheduling and quickly and easily build staff rotas one month, two months, even six months or more in advance.

And with the built-in artificial intelligence, Sling automatically reminds you of requested time off, double bookings, and overtime hours so you can finalize the schedule in less time and with less effort.

Sling also acts as a time clock for your business so you can accurately track when your team members work. Because Sling works on a variety of devices, you can set up a central terminal or allow your employees to clock in and out right from their mobile devices.

And with Sling’s powerful geofencing feature, you can prevent early clock-ins, missed clock-outs, and time theft with the touch of a button.

Sling even lets you optimize labor costs by setting wages for each individual employee or position so you can see how much each shift will cost your business.

You can also keep track of your labor budget and receive alerts when you’re about to exceed those numbers.

All of this — and much more — will help you save money and increase profits regardless of whether you choose to classify your team as FLSA exempt or non-exempt employees.

For more free resources to help you manage your business better, organize and schedule your team, and track and calculate labor costs, visit GetSling.com today.

See Here For Last Updated Dates: Link

This content is for informational purposes and is not intended as legal, tax, HR, or any other professional advice. Please contact an attorney or other professional for specific advice.

Schedule faster, communicate better, get things done.